Canadian dollar and Mexican peso fall on Trump tariff threat; UK house price growth slows

Good morning, and welcome to our live coverage of business, economics and financial markets.

Canada and Mexico are bracing for the impact of 25% US tariffs after Donald Trump said they would be imposed on Saturday.

Trump blamed the countries for his decision to impose tariffs. Both have a close trading relationship with the US, partly because of North American free trade deals, including the one he passed in 2020. Bloomberg News reported that he said:

We’ll be announcing the tariffs on Canada and Mexico for a number of reasons. Number one is the people that have poured into our country so horribly and so much. Number two are the drugs, fentanyl and everything else that have come into the country. Number three are the massive subsidies that we’re giving to Canada and to Mexico in the form of deficits.

The Canadian dollar fell 0.4% during Asian market trading on Friday, while the Mexican peso slumped by 0.6% against the US dollar.

Oil prices also rose. The price for futures of West Texas Intermediate, the North American oil benchmark, rose by 0.6% to $73.17 per barrel, while prices for Brent crude futures, the North Sea benchmark, rose by 0.3%. Trump has not said whether Canadian oil will be subject to tariffs, although that would run counter to his hopes for lower oil prices.

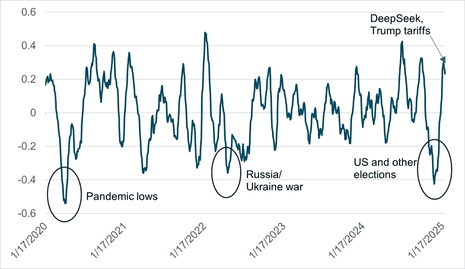

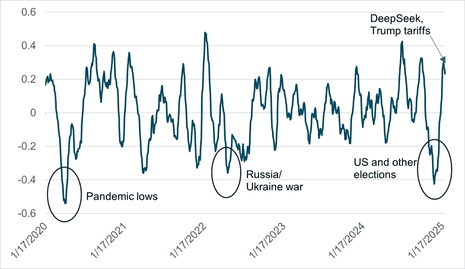

Bob Savage, head of markets strategy and insights at BNY, a US investment bank, said that the emergence of the DeepSeek AI competition earlier this month and Trump’s tariff threats could puncture the buoyant mood on financial markets. The combination could be an “inflection point” in the mood among investors.

Our data show that investors are getting used to Trump’s policy shifts and rhetoric. Fear of a meaningful change in immigration policy, tariffs and spending has not been borne out.

However, Savage warned that “investing requires greater clarity about the scope, size and reach of Trump’s tariffs”. He wrote:

Our mood index, which captures equity buying against bill selling, remains extremely positive but with peaks this week, suggesting significant downside risks for the month ahead.

Mohit Kumar, who covers global economics at Jefferies, a US investment bank, said:

It is possible that Trump goes ahead with the 25% announcement for Mexico and Canada, which would be market negative. However, we still view tariffs as a negotiating tool and even if Trump does go ahead with the tariffs, it will be followed by a period of intense negotiations and eventually a portion of tariffs will be pulled back. But come Monday morning, there is a possibility of market volatility around tariff news.

UK house price growth slowed says Nationwide

The price of an average UK home rose by 4.1% year-on-year in January, a “modest slowing” compared with December, according to Nationwide, the UK’s largest building society.

House prices increased by 0.1% month on month, after taking account of seasonal effects. That leaves the average price at £268,213, according to the transactions Nationwide tracked.

Robert Gardner, Nationwide’s chief economist, said:

The housing market continues to show resilience despite ongoing affordability pressures.

While there has been a modest improvement over the last year, affordability remains stretched by historic standards. A prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – well above the long-run average of 30%.

The agenda

-

8:55am GMT: Germany unemployment rate (January; previous: 6.1%; consensus: 6.2%)

-

9am GMT: European Central Bank survey of forecasters

-

1pm GMT: Germany inflation rate (January; prev.: 2.6%; cons.: 2.6%)

-

1:30pm GMT: US core personal consumption expenditure inflation rate (December; prev.: 0.1%; cons.: 0.2%)

Key events Show key events only Please turn on JavaScript to use this feature

Engine Capital’s lead investors, Arnaud Ajdler and Brad Favreau, may not be awake yet if they are in the hedge fund’s offices in New York, but when they do hear the news of Smiths Group’s break-up plans they are likely to be happy.

In their letter to the Smiths board on 17 January, they argued that “The value creation opportunity is significant and within the board’s reach”. That argument has been borne out very quickly.

The stock has gained 18% since the letter. Engine said it had taken “economic ownership close to 2%” before sending it. That would leave them with a return of about £22m if they bought in on the day before the letter, according to my rough calculations - although they probably bought in significantly earlier.

Yet now the question is whether they will push further for Smiths to leave the London Stock Exchange entirely. Engine had argued that the John Crane business would be valued more highly in the US. They wrote:

A listing of John Crane in the US, in conjunction with a sale of the company’s three other businesses, would create material value for Smiths’ shareholders.

That would add to the exodus of big businesses from the UK in search of higher valuations elsewhere.

FTSE 100's Smiths Group value surges after break-up plan

The share price of FTSE 100 engineering company Smiths Group has surged by as much as 17% after it said that it would bow to activist investor pressure and sell off its baggage scanning business and extend share buybacks.

It will spin off Smiths Detection, whose equipment scans bags at airports by demerger or sale, after hedge fund Engine Capital argued two weeks ago that the group was suffering from a “conglomerate discount”, and that it would be better for shareholders if it were split into parts.

It will also sell Smiths Interconnect, that makes specialised electronic components, and extend a share buyback programme from £150m to £500m.

The share price surged to a record high of £21.88 on Friday morning, before falling back to £21.10. That was far above the levels above £15 hit in November, or less than £8 per share at the worst of the coronavirus pandemic, when its detection business suffered from the decline in air travel.

The share price jump on Friday morning added the best part of a billion pounds to Smiths’s market value in early trading, before falling back. Its share price had implied a valuation of £6.4bn on Thursday evening.

The break-up would leave Smiths to focus on its John Crane and FlexTech businesses, which make seals and hoses that are crucial to all kinds of pumps and turbines.

It would also give a rapid investment return to Engine Capital, which only announced its campaign on 17 January.

Roland Carter, Smiths Group chief executive, claimed that he had been working on the plan for some time, without mentioning Engine Capital. He said:

We are pleased with the financial and operating performance of the group over recent years, including the recent upgrade to earnings. Against this strong backdrop and since my appointment, the board has spent considerable time evaluating the options to maximise shareholder value and address the persistent discount to the significant value embedded within the group.

We start from a position of strength and as we execute this strategy, we will become a more focused business with significant potential for future growth and value creation. Focusing on our world-class John Crane and Flex-Tek businesses and carefully managing the separation of Smiths Interconnect and Smiths Detection, we will deliver significant value for all stakeholders.

European stock markets have moved in lockstep at the opening bell on Friday morning.

Here are the opening snaps via Reuters:

-

EUROPE’S STOXX 600 UP 0.2%

-

BRITAIN’S FTSE 100 UP 0.2%; GERMANY’S DAX UP 0.1%

-

FRANCE’S CAC 40 UP 0.2%; SPAIN’S IBEX UP 0.2%

-

EURO STOXX INDEX UP 0.2%; EURO ZONE BLUE CHIPS UP 0.2%

Canadian dollar and Mexican peso fall on Trump tariff threat; UK house price growth slows

Good morning, and welcome to our live coverage of business, economics and financial markets.

Canada and Mexico are bracing for the impact of 25% US tariffs after Donald Trump said they would be imposed on Saturday.

Trump blamed the countries for his decision to impose tariffs. Both have a close trading relationship with the US, partly because of North American free trade deals, including the one he passed in 2020. Bloomberg News reported that he said:

We’ll be announcing the tariffs on Canada and Mexico for a number of reasons. Number one is the people that have poured into our country so horribly and so much. Number two are the drugs, fentanyl and everything else that have come into the country. Number three are the massive subsidies that we’re giving to Canada and to Mexico in the form of deficits.

The Canadian dollar fell 0.4% during Asian market trading on Friday, while the Mexican peso slumped by 0.6% against the US dollar.

Oil prices also rose. The price for futures of West Texas Intermediate, the North American oil benchmark, rose by 0.6% to $73.17 per barrel, while prices for Brent crude futures, the North Sea benchmark, rose by 0.3%. Trump has not said whether Canadian oil will be subject to tariffs, although that would run counter to his hopes for lower oil prices.

Bob Savage, head of markets strategy and insights at BNY, a US investment bank, said that the emergence of the DeepSeek AI competition earlier this month and Trump’s tariff threats could puncture the buoyant mood on financial markets. The combination could be an “inflection point” in the mood among investors.

Our data show that investors are getting used to Trump’s policy shifts and rhetoric. Fear of a meaningful change in immigration policy, tariffs and spending has not been borne out.

However, Savage warned that “investing requires greater clarity about the scope, size and reach of Trump’s tariffs”. He wrote:

Our mood index, which captures equity buying against bill selling, remains extremely positive but with peaks this week, suggesting significant downside risks for the month ahead.

Mohit Kumar, who covers global economics at Jefferies, a US investment bank, said:

It is possible that Trump goes ahead with the 25% announcement for Mexico and Canada, which would be market negative. However, we still view tariffs as a negotiating tool and even if Trump does go ahead with the tariffs, it will be followed by a period of intense negotiations and eventually a portion of tariffs will be pulled back. But come Monday morning, there is a possibility of market volatility around tariff news.

UK house price growth slowed says Nationwide

The price of an average UK home rose by 4.1% year-on-year in January, a “modest slowing” compared with December, according to Nationwide, the UK’s largest building society.

House prices increased by 0.1% month on month, after taking account of seasonal effects. That leaves the average price at £268,213, according to the transactions Nationwide tracked.

Robert Gardner, Nationwide’s chief economist, said:

The housing market continues to show resilience despite ongoing affordability pressures.

While there has been a modest improvement over the last year, affordability remains stretched by historic standards. A prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – well above the long-run average of 30%.

The agenda

-

8:55am GMT: Germany unemployment rate (January; previous: 6.1%; consensus: 6.2%)

-

9am GMT: European Central Bank survey of forecasters

-

1pm GMT: Germany inflation rate (January; prev.: 2.6%; cons.: 2.6%)

-

1:30pm GMT: US core personal consumption expenditure inflation rate (December; prev.: 0.1%; cons.: 0.2%)

.png) 2 months ago

29

2 months ago

29