European markets hit by trade war anxiety.

European stock markets are a sea of red in early trading, after Donald Trump rattled investors by signing off on tariffs on China, Canada and Mexico last weekend.

Germany’s DAX index has fallen by 2% at the open, while France’s CAC 40 share index is down 1.9%.

Spain’s IBEX has dropped by 1.7% and Italy’s FTSE MIB has lost 1.4%.

Naeem Aslam, chief investment officer at Zaye Capital Markets, says investors are bracing for heightened uncertainty in global trade and economic stability, adding:

These downturns are driven by investor anxiety about the broader impact of tariffs on the global economy, particularly as European economies are highly intertwined with U.S. trade policies.

Key events Show key events only Please turn on JavaScript to use this feature

Markets are bracing for another volatile week as Trump’s tariff policies take centre stage, reports Daniela Sabin Hathorn, senior market analyst at Capital.com.

The confirmation of 25% tariffs on Mexico and Canada over the weekend caught markets somewhat off guard, despite Trump’s prior hints. The lack of a clear economic rationale behind this decision — justified primarily as a measure to curb illegal immigration and fentanyl imports — has unsettled investors, leading to a risk-off sentiment at the start of the week.

The initial market reaction has favoured safe-haven assets, with the US dollar, Japanese yen, and gold gaining momentum this morning. Equities, on the other hand, are struggling.

Tariffs weigh on corporate earnings by squeezing profit margins and slowing future growth. They also impact valuations by reducing the likelihood of a Federal Reserve rate cut. As a result, major US equity futures opened lower during the Asian session. This decline comes at a time when equities were already considered overextended and expensive, with confidence still shaken from last week’s DeepSeek meltdown. The introduction of tariffs has further dampened the outlook for equities.

Inflation across the eurozone has risen, adding to the economic pressures on the region even before a global trade war kicks off.

Prices across the euro area rose by 2.5% in the year to January, up from 2.4% in the year to December.

A jump in energy prices lifted inflation – energy inflation rose to 1.8%. from 0.1% in December.

Services prices rose by 3.9%, while food, alcohol & tobacco prices rose by 2.3%, and goods prices rose by 0.5%.

Economists had expected eurozone inflation to remain at 2.4%.

Kyle Chapman, FX markets analyst at Ballinger Group, says:

A 0.1% miss on estimates feels somewhat irrelevant while there is a trade war erupting in North America and the markets are bracing for Trump’s actions towards the EU, of course, and investors have taken the upside surprise in their stride.”

The tumble in the UK’s stock market today highlights the global damage that a trade war can cause.

Joshua Mahony, analyst at Scopemarkets, explains:

While Trump indicated that US-UK relations would remain largely unaltered, the losses seen throughout both the FTSE 100 and 250 highlight the perception that this trade war will hurt businesses across the globe irrespective of whether they are directly impacted by tariffs.

The consequences for global markets will come down to whether nations respond with a tit for tat levy on US goods rather than striking a deal that would seek to bring an end to this crisis. Nonetheless, today is a brutal reminder for investors that Trump’s pro-business approach may not necessarily always translate into market friendly announcements. Volatility is back and it’s here to stay.

US stock market heading for losses as trade war fears spook investors

Wall Street is still expected to drop sharply when trading begins, in over four hours time.

The Dow Jones industrial average is expected to drop by around 1%, while the tech-focused Nasdaq is down 1.8% in the futures market.

Russ Mould, investment director at AJ Bell, says:

“The prospect of a full-blown trade war has spooked investors as they weigh up the prospect of widespread retaliation by countries on the receiving end of Donald Trump’s tariff frenzy.”

“Affected countries aren’t going to take the hit lying down and a tit-for-tat scenario is now looking real. That could result in higher inflation and put a stop to further interest rate cuts for the time being – exactly the opposite of what equity investors want to happen.

“Higher prices could hurt demand, and there might be a trickle-down effect that knocks business and consumer confidence and feeds into weaker economic activity.

Oil price jumps

The price of oil has jumped this morning, as traders anticipate supply disruption due to the US tariffs announced last weekend, which include 10% on Canadian oil.

The price of a barrel of US crude oil has risen by 2% to $74 per barrel, while Brent crude – the international benchmark – is up 1.2% to $76.57.

Saxo’s strategy team say:

Oil prices surged, led by US WTI, after Trump imposed significant tariffs on various imports, including crude oil from Canada and Mexico, raising concerns about higher gasoline and diesel costs for US consumers.

But… demand for oil could suffer if a trade war hits global growth, weakening take-up of energy.

BNP Paribas: An inflationary shock for the US

The Markets 360 team at BNP Paribas have warned that the new tariffs will be “an inflationary shock for the US”.

They predict that US inflation will ‘rise sharply’ in the months ahead – due to the direct impact of tariffs being passed onto consumers, and ‘second round’ effects such as higher wages.

They told clients this morning:

-

The announcement of higher US trade tariffs confirms our core assumption that Donald Trump’s campaign promises should be taken literally and seriously.

-

In fact, the announced increase in tariffs were even larger and came faster than we had pencilled in.

-

In turn US consumer prices should rise sharply over the coming months, while tariffs should put the brakes on economic growth.

-

This cements the Fed’s ‘on hold’ stance, with the direction of the next move to be determined by the balance of growth, inflation and market reaction.

-

For the rest of the world, the increase in protectionism is a clear net negative for growth, not least because the risk of a tit-for-tat escalatory trade war has risen.

-

We continue to see a more ambiguous impact on inflation outside of the US, and thus the implication for other central banks will depend in large part on starting domestic economic conditions.

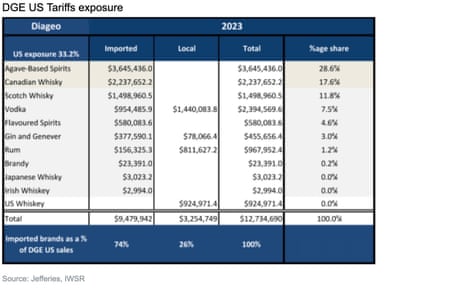

Drinks giant Diageo are among the top fallers in London, on concerns that it will be hurt by US tariffs on imports from Mexico and Canada.

Diageo’s shares are down 3.1%, a day ahead of a crucial half-year results presentation expected tomorrow.

Investment bank Jefferies have calcuated that 46.2% of Diageo’s US sales are imported from Mexico and Canada, including brands such as Crown Royal, Don Julio and Casamigos.

Diageo, as well as other European drinks makes such as Pernod, Campari and Remy, could alaso be hurt by potential higher tariffs of EU products into the US, Jefferies add.

Diageo’s chief executive, Debra Crew, knows the US market well having been president of the company’s North America region before becoming CEO in 2023.

Her tenure, though, has seen a shock profits warning, adverse global consumer trends and investor disquiet – as covered here.

Britain’s short-term borrowing costs have dropped to their lowest level in over three months this morning.

The yield, or interest rate, on two-year UK bonds has dropped to 4.17%, down from 4.21% on Friday night, and the lowest since the end of October.

That could be good news for borrowers, as two-year bond yields are used to price fixed-rate mortgages.

It suggests City traders are more confident that UK interest rates will fall this year, with three quarter-point cuts fully priced in.

Shares in some of the biggest European carmakers have slumped this morning.

Volkswagen, BMW, Porsche, Volvo Cars, Stellantis, and truckmaker Daimler Truck all fell between around 5% and 6%. French car parts supplier Valeo slid by 8%.

Markets are retreating sharply today because investors had not expected a robust response from the countries hit by new US tariffs.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, explains:

‘’Investors are rattled at the prospects of a full-blown trade war breaking out after the US slapped punishing tariffs on Canada, Mexico and China, prompting retaliation. Investors are buckling up for a rollercoaster ride for the global economy, with the European Union expected to be next in line for punitive duties. The FTSE 100 has been stopped in its tracks with the record run upwards going into reverse. It fell sharply in early trade amid worries that listed multinationals could be caught in the cross-fires of the trade wars. Japan’s Nikkei traded sharply lower, as investors assessed the repercussions for big corporates. European indices are also set for a rocky day of trading and Wall Street is set to open firmly in the red.

What was considered to be bluff and bluster from Trump has turned into cold hard reality. But President Trump is no longer the only one playing hardball. Canada’s outgoing Prime Minister Trudeau immediately imposed tit-for-tat 25% tariffs on $155bn in US imports. Mexico’s President has also ordered retaliatory action.

These new aggressive actions on what used to be neighbouring allies, are the modus operandi of the new Trump administration, and part of not just trade policy but national security strategy.

Britain’s smaller share index, the FTSE 250, is also sliding in early trading.

The FTSE 250, which is more UK-focused than the FTSE 100, has shed 1.7% – with only six stocks rising, one flat, and the remaining 243 shares falling.

Investment bank Jefferies believe a deal will eventually be reached that means trade wars can be avoided, or limited.

But markets could be “bumpy” over the coming days or weeks, they warn, due to uncertainty over the situation.

Jefferies analyst Mohit Kumar says:

Tariffs and likely counter tariffs are dominating market price action today. The fact that tariffs are coming is not new news, but market (and our expectations) had been that Trump would threaten tariffs, given some time for negotiations and then eventually a deal will be reached

"Trump tariff tantrum" hits markets

The US stock market is also heading for heavy falls when it opens later today, as Richard Hunter, Head of Markets at interactive investor, explains:

February seems likely to begin with a Trump tariff tantrum, with very early futures prices signalling declines of more than 600 points for the Dow Jones, and declines of 2% or more for the benchmark S&P500 and Nasdaq indices.

This follows the announcement on Saturday that the President would be introducing 25% tariffs on Mexico and Canada, and 10% on China. Each of the affected countries threatened retaliatory action, prompting fears of a trade war which could impact corporate earnings, supply chains and economies more generally. An unintended consequence could even be that countries look to lessen their reliance on the US, which could weaken the currency in due course.

While there is a glimmer of hope for some easing of the tariffs, with the President reportedly planning talks with Mexico and Canada today, the speed of the measures so soon after his inauguration has taken many by surprise.

European markets hit by trade war anxiety.

European stock markets are a sea of red in early trading, after Donald Trump rattled investors by signing off on tariffs on China, Canada and Mexico last weekend.

Germany’s DAX index has fallen by 2% at the open, while France’s CAC 40 share index is down 1.9%.

Spain’s IBEX has dropped by 1.7% and Italy’s FTSE MIB has lost 1.4%.

Naeem Aslam, chief investment officer at Zaye Capital Markets, says investors are bracing for heightened uncertainty in global trade and economic stability, adding:

These downturns are driven by investor anxiety about the broader impact of tariffs on the global economy, particularly as European economies are highly intertwined with U.S. trade policies.

UK bank shares are also falling, with Lloyds Banking Group down 1.8%, NatWest down 1.9% and HSBC falling 1.4%.

Barclays, which was hit by an IT glitch that left thousands of customers locked out of their accounts on Friday and Saturday, are down 2.5%.

FTSE 100 index falls 1.25% at the open

Britain’s stock maket has joined the global selloff triggered by Donald Trump’s imposition of tariffs on Canada, Mexico and China last weekend.

The blue-chip FTSE 100 index, which tracks the one hundred largest companies listed in London, has fallen by 1.25% at the start of trading.

The FTSE 100 share index has shed 111 points to hit 8562 points, falling back from the record high hit last Friday.

Nearly every share is down, led by asset managers Polar Capital (-4.5%) and Intermediate Capital Group (-3.75%).

Mining firm Antofagasta (-3.5%), and Scottish Mortgage Investment Trust (-3.7%) are also among the top fallers.

City traders will be donning their virtual tin hats, as the London stock market is about to open, and shares are expected to fall….

Metal prices hit

Metal prices have fallen today, as president Trump’s 10% tariff on imports from China rattles the markets.

Benchmark copper fell by 1.05% to $8,953 a metric ton early this morning, its lowest level since 6 January.

The three-month aluminium contract fell 1.4% to $2,558, the lowest in over two weeks.

LME zinc fell 1.2% to $2,708 a ton, lead shed 0.7% to $1,936.5, tin eased 0.9% to $29,845 and nickel lost 0.4% to $15,145, Reuters reports.

The odds of the Bank of England cutting interest rates several times this year are rising, amid fears of global trade conflict.

The money markets are now pricing in 80 basis points, or 0.8 percentage points, or cuts to Bank Rate by the end of this year. That means three quarter-point cuts are fully priced in with the possibility of a fourth.

That’s up from 75 basis points of cuts expected last Friday.

UK RATE FUTURES POINT TO ABOUT 80 BASIS POINTS OF BANK OF ENGLAND RATE CUTS BY END OF 2025 VS ABOUT 75 BPS ON FRIDAY

— PiQ (@PiQSuite) February 3, 2025The Bank is due to set interest rates at noon on Thursday, and a quarter-point cut – from 4.75% to 4.5% – is a 98% chance, according to this morning’s pricing.

.png) 3 months ago

32

3 months ago

32