Shares in struggling retailers and ageing consumer brands surged, as amateur traders cast aside Wall Street’s skepticism and mobilized online. It’s like 2021 all over again.

But the latest meme-stock rally could be even bigger than its predecessor four years ago, when investors piled into recognizable but unloved stocks, such as the video games retailer GameStop and the movie theatre chain AMC, according to the founder of the Reddit forum that helped whip up the frenzy.

Retailer Kohl’s, camera firm GoPro, fast-food chain Wendy’s and doughnut chain Krispy Kreme each staged rapid rallies this week, driven by abrupt surges in trading volume reminiscent of the the meme-stock craze of 2021, when social media memes boosted a collection of struggling stocks, triggering extraordinary and volatile leaps in value.

Actress Sydney Sweeney helped bring clothing retailer American Eagle Outfitters into the mania after it was announced the Euphoria and White Lotus star would front the brand’s latest marketing campaign. The company’s shares surged about 10% in trading on Thursday.

Meme stocks are “about to leap-frog in size and scope and scale, so that retail traders are going to redefine what matters”, according to Jaime Rogozinski, founder of the wallstreetbets Reddit forum behind many of the volatile rallies.

“The world of finance is clearly changing, with blockchain technologies encroaching, and AI agents that trade on their own,” he said. “And the collective of retail traders is adapting along with it.”

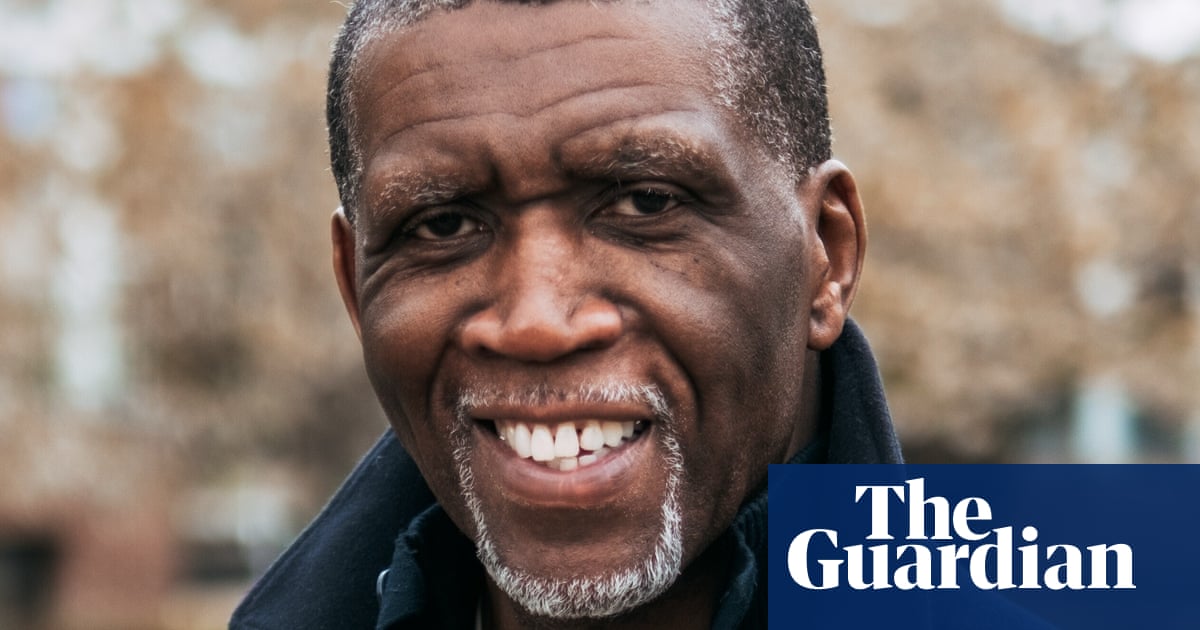

Rogozinski founded wallstreetbets in 2012, but said Reddit ousted him as a moderator in 2020. His bid to sue the social media company for trademark infringement was dismissed by the US court of appeals for the ninth circuit last month.

The forum’s users home in on stocks and share their own research. “It’s a decentralization of power of who can be financial analyst,” said Noor Al, a moderator on wallstreetbets. “Great ideas can now come from anyone, anywhere.

“We’re seeing the power of retail push stocks, sometimes to the tune of billions of dollars, through the power of ideas, the power of community and the power of the people,” he added.

The meme-stock craze of 2021, which produced stars such as Roaring Kitty, was a product of the Covid era, when many amateur traders were stuck at home and flush with pandemic stimulus cash.

Whether this latest frenzy produces similar winners is not yet clear. Kohl’s finished the week up 32%, GoPro was up 66% and Krispy Kreme was up 41%. The rallies show some investors are willing to take on more risk, as stocks scale record highs and the market, dominated by big tech, becomes harder to beat.

Often, meme-stock bets are unbound from economic fundamentals, as investors move to support a brand for romantic or ideological reasons. Donald Trump’s Trump Media & Technology Group, home to Truth Social, is valued at more than $5bn on quarterly revenue of about $1m.

The wallstreetbets ethos “has always to some extent been about flaunting and exploiting the ironies, relevance or irrelevance” of the stock market, said Rogozinski, who pointed to Wendy’s, the hamburger chain, as a good example. “Wendy’s has always been a meme that goes back a decade. It brings a smile to my face, because on Reddit there’s always been this thing where they say: ‘Sir, this is a Wendy’s.’

“It’s an inside joke, and I don’t even get where it started. It’s just a meme,” he added. The stock’s fleeting rise – it rallied 10% in two days, but finished the week broadly flat – shows some retail investors do not necessarily care about the typical factors that drive the market, such as tariffs and war in the Middle East. “It’s this ability for us to almost make fun of the financial system.”

after newsletter promotion

Long-term institutional players will always get the last laugh, Rogozinski conceded, because prices will return to normal valuations. “But in the short term there’s lot of money to be had with this volatility, and the fact that stocks are able to move up and down with such ease is but a mere showcase for how the financial system needs a facelift in relevancy.”

While current market conditions do not replicate the low interest rates and retail investor buoyancy of the Covid era, market records and a robust economy have made meme stocks attractive once again for some. “You see all these indications where this is full-blown meme mania,” Brent Kochuba, founder of derivatives-data firm SpotGamma, told Bloomberg.

“The macro economic environment really favors the retail and speculative plays,” agreed Al. “I think were only going to see more speculation and excitement. It’s a good time to tune in, because retail players can react and provide insight faster.”

Days traders are not necessarily bothered by a company’s financial performance, said Rogozinski. “You have this activist, elective investor who is saying, ‘I don’t care what the financial statements look like, I don’t care what the discounted cashflow is, I like the food, I like the video-game store, I like the meme. So dude, you can go back to Excel spreadsheets if you want, but I really like the chicken tenders,’” he said.

There is now a “third component” to investment, beyond supply and demand, he claimed, “which is, ‘dude, I don’t care if you think it’s going to go up or not, or if they have assets or liabilities. I care about this company and I’m going to help it out. I’m going to go buy my jeans from American Eagle.’”

.png) 3 months ago

37

3 months ago

37