Key events Show key events only Please turn on JavaScript to use this feature

NatWest reports strong profit, announces £750m buyback

Strong figures from NatWest this morning as it reports its first quarter as a fully privatised bank.

The lender has announced a £750m share buyback and raised its guidance for the year. Pre-tax profits of £1.8bn in its second quarter beat expectations, and the bank has told investors that it now expects income for the year to land above £16bn, compared with previous guidance of between £15.2bn and £15.bn.

NatWest announced its return to full private ownership at the end of May, ending more than a decade as the government sold the last of its shares in the bank after its bailout in 2008. Shares in NatWest have risen by roughly a quarter in the year to date, as banks have also broadly benefited from interest rates falling at a slower rate than expected.

Zoe Gillespie, of the wealth manager RBC Brewin Dolphin, has said the strong figures suggest NatWest’s big turnaround project has taken hold.

Its strategy of simplification, cost reduction, and technology integration – combined with sensible bolt-on acquisitions – is driving income growth and greater profitability. The addition of Sainsbury’s Bank, in particular, provides a real platform for further growth in UK retail banking.

Now fully in private ownership, NatWest has a freer hand to make its next big strategic move and, in the interim, shareholders are being well rewarded for their patience with a sizeable dividend increase and share buyback programme.

There is however a rather gloomy note in NatWest’s results, tucked under the bank’s notes on potential economic scenarios.

Since 31 December 2024, the near-term economic growth outlook has weakened. This was mainly due to the weaker economic performance in the second half of 2024 and the drag from international trade policy related uncertainty. Inflation has risen, with underlying price pressure remaining firm, particularly on services inflation.

As a result, inflation is assumed to remain a little higher than 3% through most of 2025, taking longer to fall back to the target level of 2%. The labour market has continued to cool. The unemployment rate peak is now assumed to be modestly higher than at 31 December 2024, but it is still expected to remain low. The Bank of England is expected to continue cutting interest rates in a ‘gradual and careful’ manner with an assumed terminal rate in the base case of 3.5%. The housing market continues to show signs of resilience, with prices still expected to grow modestly.

British retail sales rise in June, official figures show

There is some positive news for the retail sector this morning, with official figures showing that monthly sales rose in June by 0.9%. It follows a fall of 2.8% in May.

That was helped by warm weather, with supermarkets reporting better trading and an increase in drink purchases, the Office for National Statistics has said.

The warm weather in June helped to brighten sales, with supermarket retailers reporting stronger trading and an increase in drink purchases.

It was also a good month for fuel sales as consumers ventured out and about in the sunshine. pic.twitter.com/RHKdhbhxTo

While growth is encouraging, the numbers are weaker than expected. A poll by Reuters showed that economists had been expecting a monthly rise of 1.2%.

Jacqui Baker, head of retail at RSM UK and chair of ICAEW’s Retail Group, warns that the sunny mood music may not last long.

While the June figures are welcome news and consumer confidence ticked up last month, nervousness among consumers persists, and the unexpected rise in inflation won’t have helped. The higher price of essentials such as food and fuel will only add to the reluctance among consumers to spend as their discretionary income shrinks.

Concerns remain in the sector, as retailers increasingly run out of headroom to mitigate rising costs. Many will be hoping the government steps in to provide meaningful reductions in business rates, as well as raising the threshold at which employers’ National Insurance becomes payable. It’s also hoped that the reintroduction of tax-free shopping is brought back on the table, so the sector doesn’t miss out further on valuable retail spend.”

Introduction: Keir Starmer to push Donald Trump over steel tariff deal

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

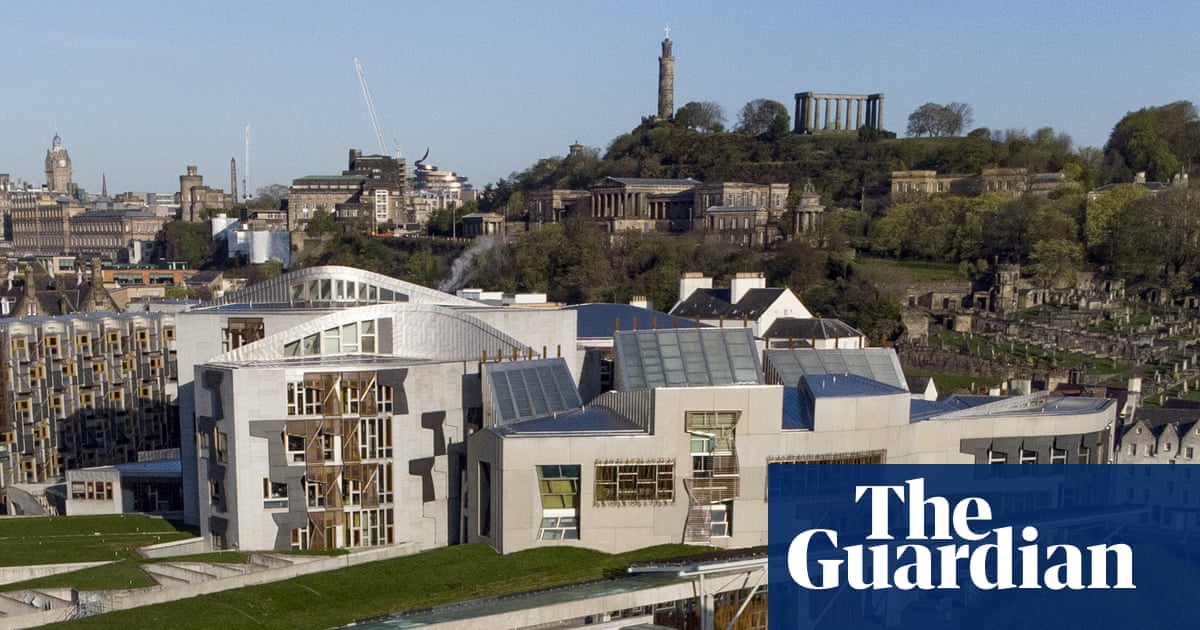

Donald Trump, who is due to arrive in Scotland on Friday for a five-day golf trip, is expected to meet with Keir Starmer early next week as the prime minister pushes to finalise their deal on steel trade tariffs.

In May, the US agreed to lift tariffs on steel imports from the UK, which currently stand at 25%. However, there are concerns that the steel must be melted and poured in the UK, which could exclude Tata Steel UK as it closed its last blast furnace last year. It has been importing steel from its sister plants in India and the Netherlands, which it then processes in the UK.

Starmer is expected to argue for building closer trade ties with the US, including cutting tariffs on Scotch whisky, according to a report by the Financial Times.

White House press secretary Karoline Leavitt told reporters this week: “On Friday morning, President Trump will travel to Scotland for a working visit that will include a bilateral meeting with Prime Minister Starmer to refine the historic US-UK trade deal.”

The talks will come after Stamer sealed a tradel deal with India on Thursday. The agreement, which is the biggest struck by Britain since Brexit, will cut back the cost of India’s tariffs for the UK and improve exports of products such as Scotch whisky and cars.

Starmer told Bloomberg News that his government had “re-established the place and position of the UK on the world stage.”

“We’re seen as a country which other countries want to be working with and delivering with.”

The agenda

-

7.00am BST: ONS retail sales data

-

7.00am BST: NatWest Q2 results

-

11.00am BST: NatWest AGM

.png) 1 month ago

20

1 month ago

20