Britain’s centre of power is stalked by a zombie. Across Westminster, the mere mention of her name summons up a grim past, but she remains ever present: blond bob, eyes that never move and a grin slightly aslant so it expresses not mirth, but faint menace. When least expected, she can bark a laugh that sends shivers up a cabinet minister’s spine. And whenever her shadow looms in SW1, the dread murmur starts: she used to be prime minister, you know.

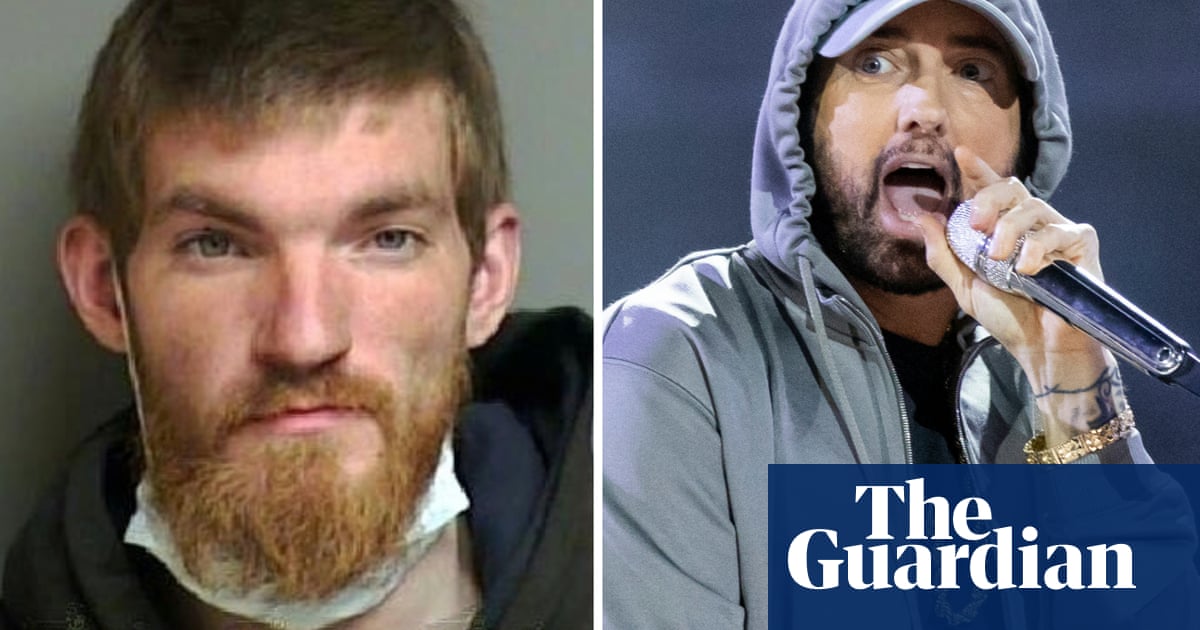

Liz Truss’s stint at the top of politics ended years ago. Perhaps close confidants and trained medics are yet to break the news, but for her, power is a fading memory, a shrinking image in the rear-view. As the voters of South West Norfolk ensured last July, she is now an ex-politician. Yet in British political culture, she is the great undead. No other prime minister since the Brexit vote so haunts current debates. It’s not just because she never belts up, never stops chuntering about how the Guardian and the BBC must be “fixed”, or siccing her lawyers on Keir Starmer. It’s also because her few days of mayhem at No 10 remains the pre-eminent cautionary tale of our times.

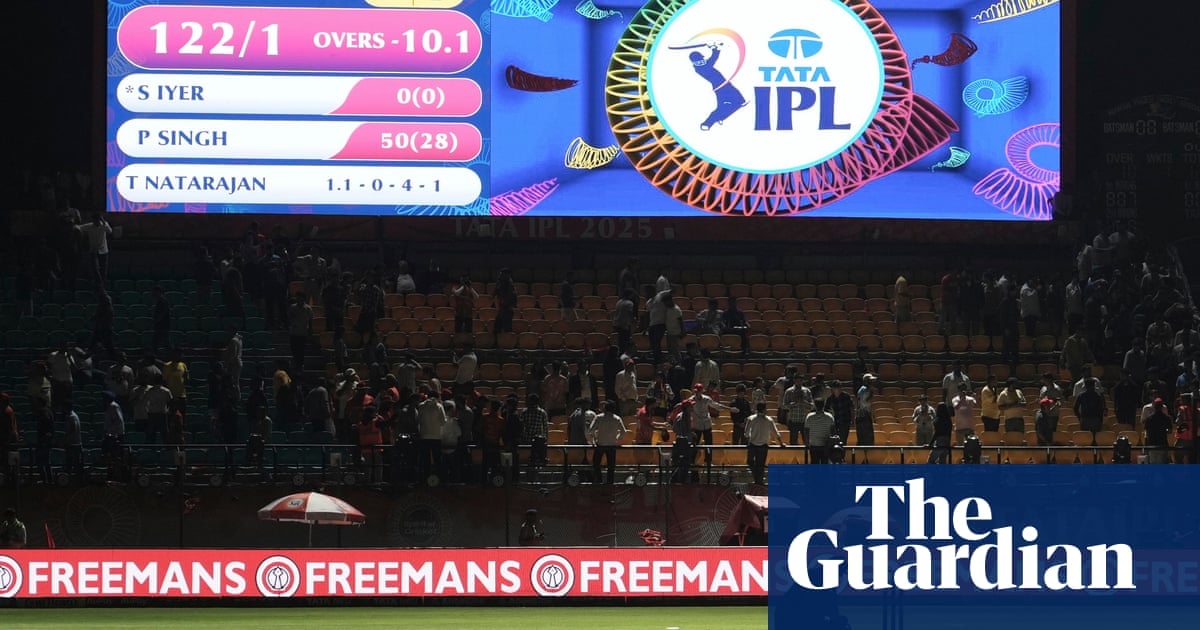

Just look at the response to the past few days of market turmoil. As investors demanded higher rates to lend to the UK government, what was the first name on the lips of our political class? “It’s Liz Truss in slow motion,” said Labour MPs. When Rachel Reeves flew off on her long-planned visit to China, the jokes were inevitably about Kwasi Kwarteng jetting back from Washington to get the sack.

Faced with this tumult, the government’s own response has borne the mark of Truss. How did her reign end? By breaking solemn promises and making spending cuts. How have Starmer and Reeves responded to this far more minor squall? By welching on a solemn pledge to have only one autumn budget, and instead promising spending cuts by March that the prime minister is already calling “ruthless”. Should they want to know why this is idiocy, they need only consult Truss. She can tell them about the doom loop ahead: under perceived pressure from financial markets, the government cuts spending, which lowers growth, which shrinks tax revenues, which makes markets more wary of lending to the government. Follow this loop for any length of time and, well, the government isn’t in government any more.

What’s happened in debt markets over the past week bears scarce likeness to the debacle we saw in 2022. Truss and Kwarteng built their own funeral pyre. They brought in an unaudited raft of tax cuts and spending commitments, then, with barely a pause to see how those went down, promised even more to come. The result was a full-on attack on UK government bonds, and UK bonds alone. This time? Any politicians and columnists claiming that bond investors are punishing Reeves for a so-so budget are just wrong. The interest rate on 10-year government loans from France to Germany to Italy has gone up over the past month, and the UK is no different. Most of this has been driven by the US, where market rates have risen markedly ahead of the arrival of Donald Trump.

Since I began my career tracking bond markets under another ex-lawyer Labour prime minister with a landslide majority, here’s a rule of thumb: on any average day when UK bonds go up or down, it’s because US bonds are up or down. Amazing, isn’t it? Now go make a million. Another rule of thumb is that, whenever this happens, some market analyst will oblige a journalist like me with a more lurid reason, and brighten up both our days.

So the sensible thing for Reeves and Starmer to say would be: “Global markets are going through some choppiness; we’ll keep monitoring the situation.” Instead, they’ve as good as promised spending cuts for two months’ time, even naming where they’ll swing the axe – which just happens to be where the axe always falls: civil servants and sickness benefits. Why do that? Again, the answer lies with Truss.

One conclusion both main parties appear to have drawn from the shortest-serving prime minister since Victorian times is that you never cross the markets. To satisfy investors’ need for stability and discipline, you have to bind yourself up in budgetary rules. Even from Beijing, the chancellor telegraphed home that her “iron-clad” fiscal rules are “non-negotiable”. Chancellors before Truss would never have bandied around such terms. Gordon Brown’s “golden rule” telegraphed to the public his priorities in tax and spending. George Osborne broke his own fiscal rules with as much anxiety as Toad of Toad Hall.

For all that Truss is cited as a cautionary lesson in modern British politics, politicians haven’t learned what she actually has to teach them. As this week’s headlines about rates hitting their highest point since the banking crash tell you, the UK has been through a long, strange, wasted decade and a half. After the pandemic, after the end of quantitative easing, money would never again be so cheap. After Brexit, a small, open country could no longer rely on what the then head of the Bank of England, Mark Carney, called “the kindness of strangers” to finance its spending habits. Just when British prime ministers needed statecraft and strong institutional backing, Truss crashed out a deeply witless budget. The comeuppance was swift.

What Truss teaches is that to change things in Britain you need cleverer politics: to think about what your public needs, argue for it, and to build institutional backing. What the Labour leadership appears to have learned from her is that you need less politics: you need more rules, you must bend more to what you think markets want. The result is a politics paradoxically close to the Truss agenda.

Truss’s goal in No 10 was the same as Starmer’s in No 10: a growth plan. She hated regulation, and wanted to rip up the planning system. Just like the Labour prime minister this week, she loved AI and thought the UK enjoyed “a unique position to lead the charge on this”. Yes, Starmer and Reeves eschew culture war rhetoric, care about redistribution, and want to keep public sector unions on side – but fundamentally, the territory they’re fighting on is hers. It’s about growth, hard hats – and spanking regulators and politicians who get in the way.

What was in the package of measures the chancellor brought back on the plane from Beijing? Yes, a deal to open up pork markets in China. (A scan of the papers suggests I am the only newspaper columnist to have noticed this. That. Is. A. Disgrace.)

Were Truss able to see any of her agenda through, we’d be asking just who benefits from any of this. We should ask the same of Reeves and Starmer. If AI brings in cash for some, but demands our data, our land, our energy, is it really a good deal? If property developers and big infrastructure firms get a freer hand, how do we get maximum payback for the rest of us? In other words, what kind of growth is good, or even feasible?

These are the big questions, and they won’t be answered by this government, just as they weren’t addressed by Truss and her chums. It’s not just one ex-PM stalking us from beyond the career grave: it’s zombie politics, zombie economics.

-

Aditya Chakrabortty is a Guardian columnist

.png) 3 months ago

40

3 months ago

40