Nearly 1 million children in the UK are at risk of falling into poverty or will face financial hardship as a result of rising rents, shortfalls in government housing support and underinvestment in new social housing, according to a new report.

The study by the Institute for Public Policy Research thinktank suggests the government’s failure to commit to raising the local housing allowance (LHA) will push 90,000 more families into financial hardship or poverty over the next year. It estimates 925,000 children are expected to be affected by shortfalls in government housing support by March 2026.

LHA rates were reduced in 2011 by the coalition government, so that now only families eligible for benefits living in the cheapest rental homes in their area – properties in the bottom 30th percentile of their local rental market – get the cost of their rent covered in full by the government.

LHA rates were also repeatedly frozen by previous Conservative governments, so that the housing allowance did not keep pace with local rents, increasing the number of families on benefits who must spend benefit income intended for their living costs on rent.

So far, the Labour government has not committed to ditching this freeze and raising LHA rates in April 2025.

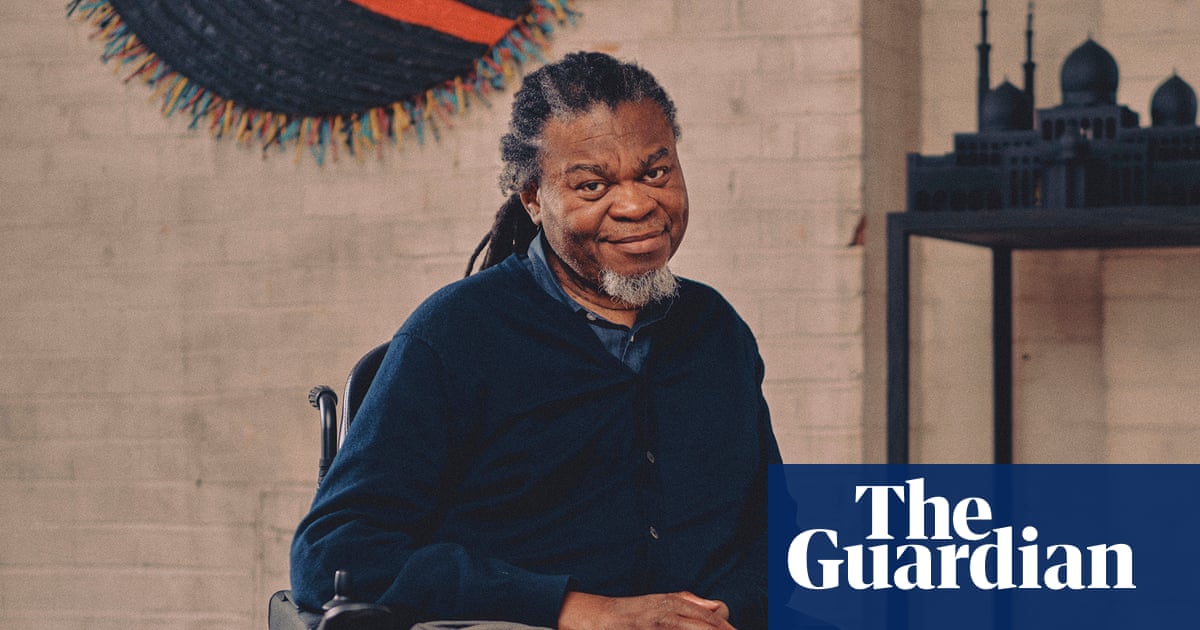

“If the local housing allowance doesn’t keep pace with your rent, then essentially you’ve got less money available for food, energy and other things,” said Prof Ashwin Kumar, a co-author of the report.

He said among the children in this situation, there would be some living “in or close to the poverty line”.

“It increases the financial pressures on families, and we’ve seen the consequences of those kinds of pressures,” he said. “When we had periods of freezes under the Conservatives, we saw high food bank usage and many other kinds of indicators of deprivation.”

Children may begin struggling at school or suffer from health problems, he said. “The Labour government should take action on the local housing allowance, so we don’t build up to those consequences.”

The number of children in the private rental sector has grown from one in 12 to one in five over the last 20 years, according to the report.

“Social housing potentially has a role to play here, because if you provide social housing to people at cheaper rates than the private rented sector, then the amount that has to be spent on housing benefits is lower. So although there’s a cost to building more social housing, it does actually reduce your benefit bill,” said Kumar.

after newsletter promotion

He would like to see the government expand the social rented sector to replace all of the homes that have been lost through the introduction of the right to buy scheme under Thatcher. “That will give more people security and bring temporary accommodation costs down.”

The report also identified a concerning postcode lottery with LHA rates. Nearly two-thirds (62%) of families renting privately in Wales face a shortfall, compared with only 31% in Scotland. The variation between different local authorities is even more stark, with 74% of claimants facing a shortfall in Neath Port Talbot, compared to just 9% in East Lothian.

A government spokesperson said: “No person should be in poverty – that’s why we’ve extended the household support fund again, are maintaining discretionary housing payments and are giving an extra £233m to councils directly for homelessness.

“Alongside this, we are uprating benefits, increasing the ‘National Living Wage’ and helping over 1 million households by introducing a fair repayment rate on universal credit deductions, while our child poverty taskforce develops an ambitious strategy to give all children the best start in life.”

.png) 2 months ago

27

2 months ago

27