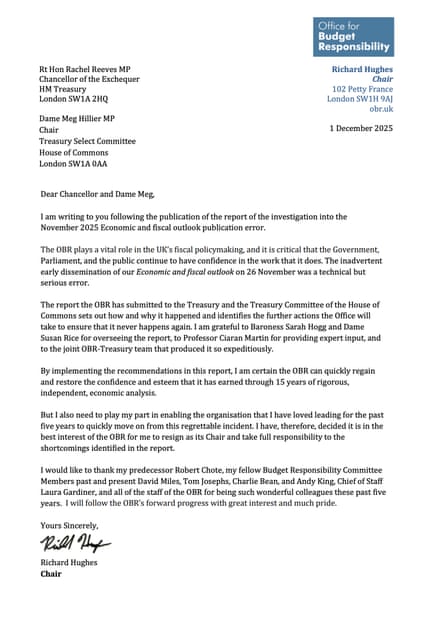

Had Richard Hughes not resigned as boss of the Office for Budget Responsibility (OBR) on Monday amid the indignation over the accidental publication of Rachel Reeves’s budget, the Treasury might now be under pressure over the tsunami of leaks that preceded it.

The OBR’s David Miles told MPs on Tuesday the leaks had been so widespread and misleadingthat the watchdog feared its reputation was at stake.

Alongside briefings about the potential direction of OBR forecasts, there were public comments too, including from Reeves herself, about the frustrating timing of the watchdog’s productivity rethink; and its refusal to “score” pro-growth policies.

Arguing for an ambitious “youth experience scheme” in September, for example – details of which are still to be negotiated – the chancellor told the Times, “we want the OBR to score it. They scored it when we left the European Union. They should score both the improved trade relationships that we’ve negotiated and this youth experience scheme.”

Reeves’s allies have made no secret about the lack of rapport between her and Hughes – a blunt former IMF and Treasury official, whose past career involved advising the Zimbabwean government about hyperinflation.

Longtime observers of the relationship between the Treasury and OBR point out that last year marked the first time Labour has had to tangle with the watchdog since it was created by George Osborne. A former Tory adviser joked: “Osborne’s trap laid in 2011 paid dividends.”

Unable to respond to the “leakfest” publicly before the budget, the OBR chair and his colleagues had raised concerns privately with Treasury officials, Miles revealed.

With the search now on for a replacement, some senior economists said any credible successor would probably seek reassurances that the institution would not face a similar onslaught in future.

Jonathan Portes, a former government adviser now at the thinktank UK in a Changing Europe, said Hughes’s departure was “not good for the UK in fiscal governance terms” and the government should have encouraged him to stay. “I don’t think his resignation is good for the government’s fiscal credibility”.

The Bank of England governor, Andrew Bailey, underlined the importance of the OBR’s independence on Tuesday, telling journalists: “Attacks on the OBR: in terms of the principle, I would say ‘no, can we please remember why it was done and the principles underlying it’.”

Hughes’s unprecedented letter last Friday, setting out the evolution of the OBR’s forecasts, reflected weeks of pent-up frustration within the concrete headquarters it shares with the Department of Justice.

He had intended to send it earlier – mentioning it in the OBR’s budget document, the Economic and Fiscal Outlook – but as Hughes’s colleague Miles confirmed on Tuesday, it was delayed by the chaos surrounding the budget’s accidental publication.

The letter was read by some at Westminster – including the shadow chancellor, Mel Stride, and some journalists – as impugning Reeves’s honesty, revealing as it did that even before her gloomy 4 November speech, the OBR was assuming she would just meet her fiscal rules.

Miles, who oversees the OBR’s forecasts and represented the watchdog at the Treasury select committee on Tuesday, scotched that idea firmly, however.

The chancellor was right to point to the shaky state of the public finances, he said. Her “headroom” by the end of the five-year forecast was “wafer thin” – and indeed, as Miles and his colleague Tom Josephs made clear, while Reeves plans to raise taxes and cut spending to expand it, there are significant questions about whether that is realistic.

Without aiming its fire directly at Reeves, however, the OBR did want to highlight the contradiction between the evolution of its forecasts – which were broadly complete by 30 October – and the excitable government briefing on 14 November.

That was the day bond markets reacted badly to news Reeves and Starmer had dropped the idea of raising income tax rates. Scrambling to calm City nerves, Treasury sources told some journalists that the change of heart resulted from improved OBR forecasts.

Miles told MPs this improvement simply “didn’t exist”. To the extent the forecasts had got better, it had happened a couple of weeks earlier, before 31 October; and there was concern inside the watchdog that all this briefing made it look as though its forecasts were “wildly fluctuating”, making the budget process “chaotic” – which, of course, it was, but not for that reason.

As the dust settles on the budget, Reeves is now looking both for a chief economic adviser – after the scaling back of John Van Reenen’s role – and a new OBR chair, at a time when she and her policies are under intense political pressure.

Plausible candidates to succeed Hughes include Bailey’s deputy, Clare Lombardelli, who has known Reeves for many years; Carl Emmerson, until recently of the Institute for Fiscal Studies; or if they prefer a consummate Treasury insider, director of public spending, Conrad Smewing. Senior government economist Nick Joicey, now at the Blavatnik school of government, might also be a solid candidate, were he not married to the chancellor.

Whoever takes on the role may take some convincing that they will be given the freedom to do their job without being publicly – and privately – second-guessed by government insiders. And investors in bond markets, which were unmoved by the leak farrago, will be watching closely to ensure whoever is appointed has the credibility and independence needed for such an impossible job.

.png) 2 months ago

65

2 months ago

65