Key events Show key events only Please turn on JavaScript to use this feature

Bosses' bonuses banned at six water companies

Sandra Laville

Bonuses for 10 water company executives in England, including the boss of Thames Water, will be banned with immediate effect over serious sewage pollution, as part of new powers brought in by the Labour government.

The top executives of six water companies who have overseen the most serious pollution events will not receive performance rewards this year, the environment said.

The companies – Thames Water, Anglian Water, Southern Water, United Utilities, Wessex Water and Yorkshire Water – are responsible for the most serious category of sewage pollution into rivers and seas, all of which are, or have been, under criminal investigation by the Environment Agency.

Under powers in Labour’s Water (Special Measures) Act 2025, the regulator, Ofwat, is now able to ban bonuses for water executives where a company fails to meet key standards on environmental and financial performance, or is convicted of a criminal offence.

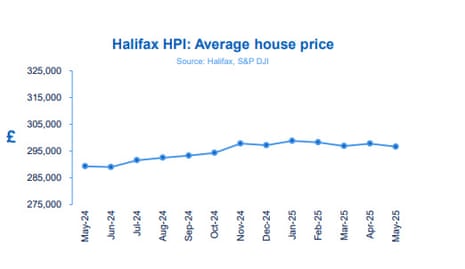

House prices: what the experts say

Here’s some early reaction to the news that UK house prices dipped by 0.4% last month.

Tom Bill, head of UK residential research at estate agent Knight Frank:

“Demand was frontloaded this year thanks to April’s stamp duty deadline, which means house prices are coming under downwards pressure as buyers still in the market have a lot to choose from.

While activity will eventually pick up, concerns around inflation and the government’s tight financial headroom mean mortgage rates don’t feel poised to drop meaningfully. We expect UK growth of 3.5% in 2025, which suggests the direction of travel for prices will be largely sideways.”

Jonathan Handford, managing director at national estate agent group Fine & Country:

“This slight month-on-month dip follows the stamp duty changes introduced in April and comes just ahead of the typically quieter summer period, when many families pause moving plans to focus on holidays and school breaks.

“Although economic pressures continue to impact personal finances, with inflation at 3.5% and household budgets feeling the squeeze, the Bank of England’s May rate cut to 4.25% has offered some welcome relief. While mortgage rates remain relatively high, any further easing in borrowing costs could help reignite market activity.

“Mortgage approvals fell in April as demand naturally cooled after the stamp duty tax break ended, and tighter lending criteria and deposit requirements still pose challenges for many buyers, particularly first-time purchasers. However, steady wage growth is providing some support, even if affordability remains a hurdle.

In this month’s @HalifaxBank HPI for May 2025 house prices took two steps back after taking two steps forward in April. Falling 0.4% to £296,648. This game of cat and mouse looks set to continue throughout the year, with rates determining the outcome. pic.twitter.com/1RKSpp4OAS

— Emma Fildes (@emmafildes) June 6, 2025Matt Swannell, chief economic advisor to the EY ITEM Club:

“After a strong start to 2025, the housing market lost momentum as March’s change in stamp duty thresholds came into view and passed. Having spiked in March, housing transactions slowed sharply in April after homebuyers had rushed to complete transactions in the nick of time. This soft patch probably has a little further to go. Mortgage approvals, which lead house purchases by a couple of months, have sunk through the first four months of this year. Earlier changes to stamp duty thresholds in 2021 also led to a temporary drop-off in housing activity.

“We think that the current weakness will prove temporary and that the conditions are in place for a modest pickup in the housing market later in 2025. Further interest rate cuts and real pay gains will support demand. But with house prices remaining high, affordability challenges and ongoing economic uncertainty will temper activity.”

Northern Ireland continues to lead annual price growth in the UK

Halifax’s report also shows that house prices are rising faster in Northern Ireland, Wales and Scotland than in England.

Here’s the details:

Northern Ireland once again recorded the fastest pace of annual property price inflation, up by +8.6% over the past year. The typical home now costs £209,388, though prices remain well below the UK average.

Wales and Scotland also posted strong annual growth of +4.8% in May. Average prices now stand at £230,405 and £214,864 respectively.

Among the English regions, the North West and Yorkshire and the Humber lead the way, both showing annual house price growth of +3.7%. Average property values in these areas are now £240,823 and £213,983 respectively.

In contrast, London continues to see more subdued growth, with prices rising by just +1.2% year-onyear. However, the capital remains by far the most expensive part of the UK housing market, with the average home now priced at £542,017.

UK house prices dip in May

British house prices fell by more than expected in May, new figures from mortgage lender Halifax showed on Friday.

Halifax said house prices fell by 0.4% in May, more than reversing a 0.3% increase in April. Economists had only expected a fall of 0.1%.

According to Halifax, average property price was £296,648 last month, down from £297,798 last month.

On an annual basis, house prices were 2.5% higher on the year – again less than expected.

Amanda Bryden, head of mortgages at Halifax, says the broader picture is that the housing market that has remained largely stable in 2025, with average prices down by just -0.2% since the start of the year.

Bryden adds:

The market appears to have absorbed the temporary surge in activity over spring, which was driven by the changes to stamp duty.

Affordability remains a challenge, with house prices still high relative to incomes. However, lower mortgage rates and steady wage growth have helped support buyer confidence.

The outlook will depend on the pace of cuts to interest rates, as well as the strength of future income growth and broader inflation trends. Despite ongoing pressure on household finances and a stilluncertain economic backdrop, the housing market has shown resilience – a story we expect to continue in the months ahead.”

Markets brace for US jobs report, after explosive Trump-Musk row

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Investors will have one eye on the US jobs market today, and the other on the spectacular blow-up between Donald Trump and Elon Musk overnight.

The latest US employment report is expected to show a slowdown in hiring across the US in May.

Economists forecast that the US non-farm payroll will have risen by around 130,000 in May, down from the 177,000 increase recorded in April, with the unemployment rate sticking at 4.2%.

A weak payrolls report could fuel fears that the US economy is slowing, as Trump’s trade wars hit activity. But it could also intensify the pressure on the US Federal Reserve to lower interest rates, something the US president has been demanding for months.

Tony Sycamore, market analyst at IG, explains:

The US unemployment rate has hovered between 4.0% and 4.2% over the past year, and a job in the unemployment rate to 4.3% or higher will heighten economic slowdown fears. The US rates market is pricing in an 85% chance of a 25bp Fed rate cut in September, with a cumulative 55bp in cuts expected by year-end.

So the markets could be volatile at 1.30pm UK time, when the non-farm payroll data lands.

Speaking of volatility… the Trump-Musk relationship exploded dramatically on Thursday, with the president and the world’s richest person slinging accusations at each other.

Shares in Tesla slumped over 14%, wiping over $150bn off the company’s value, as Trump threatened to terminate Musk’s governmental subsidies and contracts, and accused the billionaire of going “CRAZY!” over the removal of electric car subsidies.

From the other corner, Musk called for Trump’s impeachment, claimed the president appeared in the files into convicted sex offender Jeffrey Epstein, and briefly threatened to decommission SpaceX’s Dragon spacecraft.

It all added up to another bruising day for shareholders in Tesla, whose value had already been hit by the backlack against Musk’s role in the Trump Administration.

Some traders will have been betting on further falls in Tesla’s share price, as Chris Weston, head of research at Pepperstone, explains:

The selling in Tesla stock on the day has been wholly impressive with 285m shares traded on the day – the most since Jan 2023 – with a ‘sell first, ask questions later’ mentality sweeping through the shareholder base.

In the options space, over 4m put options traded hands, 4x the 20-day average.

The agenda

-

7am BST: Halifax house price index

-

8.30am BST: UN FAO food price index

-

10am BST: Eurozone GDP report for Q1 2025 (3rd estimate)

-

11.30am BST: Bank of Russia interest rate decision

-

1.30pm BST: US non-farm payroll report

.png) 3 months ago

60

3 months ago

60