Key events Show key events only Please turn on JavaScript to use this feature

Stock market slightly higher in first trading day of the year

The UK’s blue chip FTSE 100 index is up slightly by 0.19% as the market opens for its first trading day of 2026. Miners are among the best performers across the index, with Fresnillo leading the pack, up 4%.

The mid-cap FTSE 250 index is also rising this morning, up 0.18%. Over in Europe, the Stoxx Europe 600 index has risen by 0.27%.

House prices were 'resilient' in 2025 despite softer end to the year, Nationwide says

House prices faltered slightly in December, but overall the UK’s property market was resilient in 2025, Nationwide says.

Robert Gardner said:

Despite the softer end to the year, the word that best describes the housing market in 2025 overall is ‘resilient’. Even though consumer sentiment was relatively subdued, with households reluctant to spend and mortgage rates around three times their post pandemic lows, mortgage approvals remained near pre-Covid levels.

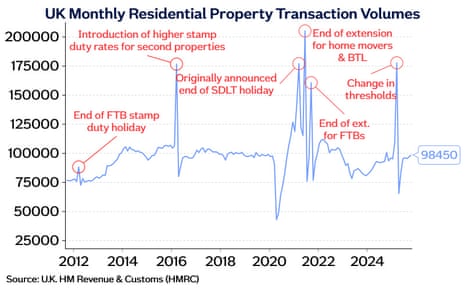

Stamp duty changes that took effect at the beginning of April created volatility through the spring and summer. Activity spiked in March as purchasers brought forward transactions to avoid paying additional tax and this led to some softness in the following months. However, the underlying picture was little changed as demand held up well throughout.

Looking ahead to 2026, Nationwide now expects that annual house price growth will be in the range of 2% to 4%, as income growth is forecast to outpace house price growth, and economists expect a modest decline in interest rates.

Gardner adds the changes to property taxes announced in the government’s last budget are “unlikely” to have a significant impact on the market.

The high value council tax surcharge is not being introduced until April 2028 and will apply to less than 1% of properties in England and around 3% in London. The increase in taxes on income from properties may dampen buy-to-let activity further and hold down the supply of new rental properties coming onto the market, which could, in turn, maintain some upward pressure on private rental growth.”

Amy Reynolds, head of sales at the estate agency Antony Roberts in Richmond, said the expectation of continued lower mortgage rates should help restore buyer confidence this year.

There is more optimism and a feeling of relief now that the budget is over. We do not expect huge price rises and a racing market, more a return to the normal pre-budget market which has been on hiatus while everyone waited to see what the government would roll out.”

Introduction: House prices drop unexpectedly in December

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices dropped unexpectedly by 0.4% in December, according to the latest figures from the lender Nationwide Building Society.

It found that house prices fell slightly in December compared with November, ending the year just 0.6% higher compared with the year before.

Economists polled by Reuters had forecast a 0.1% monthly rise, with an annual change of 1.2%.

Robert Gardner, Nationwide’s chief economist, said:

UK house prices ended 2025 on a softer note, with annual price growth slowing to 0.6%, from 1.8% in November, the slowest pace since April 2024.

The high base for comparison can partly explain the slowdown (annual price growth was a solid 4.7% in December 2024), although prices fell by 0.4% month on month, after taking account of seasonal effects.

Most regions across the UK reported modest house price growth in the final quarter of the year, with East Anglia the only region to post an annual decline of 0.8%. The strongest was Northern Ireland, where prices rose by 9.7% on annual basis.

The average price for a home in the UK was £273,077 in the final quarter of the year, Nationwide said. At the end of December, it was £271,068.

Elsewhere, the supermarket Lidl has said its revenue in the UK surpassed £1.1bn in the four weeks running up to Christmas Eve.

The supermarket, which has been rapidly expanding across the UK with new store openings, said it welcomed nearly 51 million customers through its doors, up 8% compared with the year prior. The busiest day for footfall was 23rd December, it said.

Its data suggests that shoppers bought more than 11,000 tonnes of seasonal produce in the week leading up to Christmas Eve, a 70% year-on-year increase, including an almost 40% rise in easy-peeler clementines alone.

Ryan McDonnell, chief executive at Lidl GB, said:

2025 was a record-breaking Christmas for Lidl – with more customers choosing to shop with us than ever before. By continuing to invest in low prices and champion British food, all without compromising on quality, we’ve seen loyalty soar. We remain the retailer that delivers the highest quality at the best price.

The agenda

-

7.00am GMT: Nationwide house price index for 2025

-

9.00am GMT: Eurozone manufacturing PMI

-

9.30am GMT: UK manufacturing PMI

-

2.45pm GMT: US manufacturing PMI

.png) 1 month ago

48

1 month ago

48