Introduction: US and China agree to framework deal to restore trade war truce

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

“Jaw, jaw is better than war, war,” as Harold Macmillan once remarked. And after two days of talking in London, the US and China have managed to patch up their trade conflict truce.

Just before midnight last night the two countries agreed a framework that, it is hoped, will ease tensions between the two economic superpowers. It will reinforce their initial agreement made in Geneva a month ago, once presidents Donald Trump and Xi Jinping have approved it.

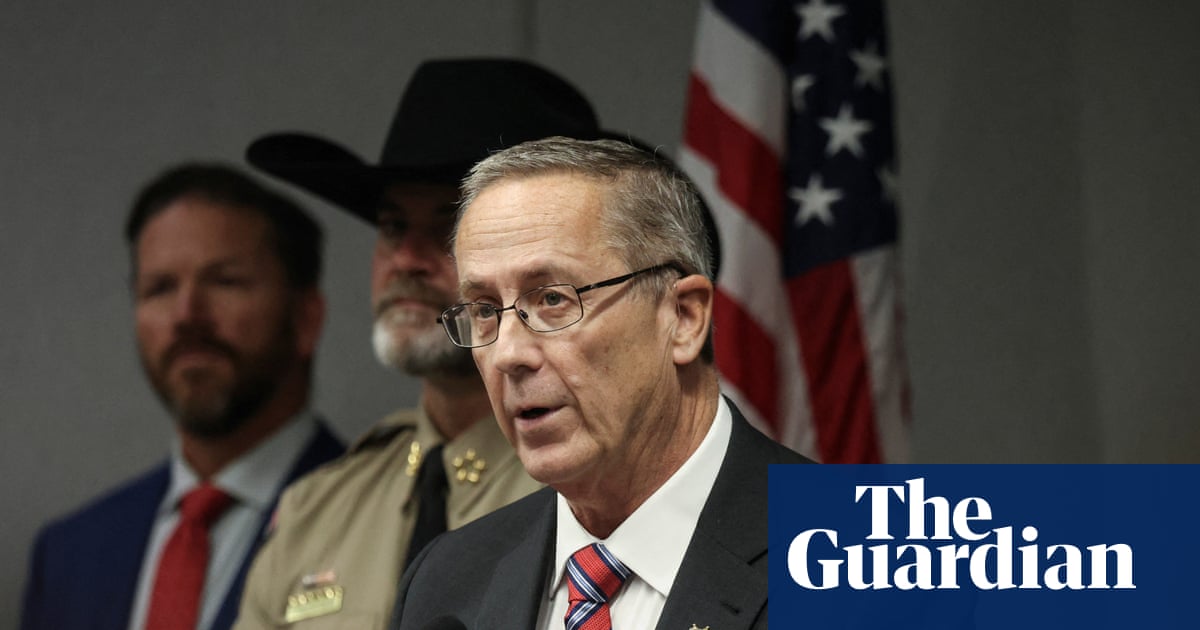

Speaking at Lancaster House last night, US commerce scretary Howard Lutnick said the trade framework and implementation plan agreed with China in London should result in restrictions on rare earths and magents being resolved.

That had been a key demand for the US side, worried that American companies were being starved of vital supplies.

Lutnick told reporters the US negotiating team will take the framework back to Trump to get his approval, and then hope to implement it.

Lutnick says they had to get the “negativity out” first when it comes to the US-China trade relationship.

“It's been President Trump's fundamental goal to reduce the trade deficit and increase trade. So this was the first step that the framework by which we will then approach…

China’s vice commerce minister Li Chenggang described the talks as “rational and candid”, telling reporters:

“The two sides have, in principle, reached a framework for implementing the consensus reached by the two heads of state during the phone call on June 5th and the consensus reached at the Geneva meeting.”

The talks, which began on Monday morning, took longer than expected – with the two sides sustained by deliveries from restaurant chain Ottolenghi, McDonald’s, Burger King and KFC.

Investors are now waiting for details of the agreement, and confirmation that it will satisfy Xi and Trump.

Traders are also anticipating the latest US inflation report, which may show that the trade war has driven up prices in the shops. Economists predict the US CPI index will have risen to 2.5%, from 2.3%.

While in London, chancellor Rachel Reeves will deliver the government’s spending review, outlining day-to-day departmental spending for the next three years.

The agenda

-

12pm BST: US weekly mortgage applications data

-

12.30pm BST: Chancellor Rachel Reeves to deliver UK spending review

-

1.30pm BST: US inflation report for May

Key events Show key events only Please turn on JavaScript to use this feature

US and Mexico 'discuss deal to cut Trump's steel tariffs'

The US and Mexico may be close to a breakthrough in negotiations over steel tariffs.

Reuters are reporting that the two countries are negotiating a deal to reduce or eliminate President Donald Trump’s 50% steel tariffs.

An industry source familiar with the talks said that a likely outcome would include a quota arrangement, under which a specified volume from Mexico could enter duty free or at a reduced rate and any imports above that level would be charged the full 50% tariff.

Reuters add that it’s unclear whether the deal would eliminate tariffs altogether for in-quota steel import volumes from Mexico or reduce them to a lower level, and that the specific volume level of the quota also was not yet determined.

Trade framework agreed: What the analysts say

Reaction to the US-China agreement is flooding in this morning, as analysts digest the overnight news that a ‘framework’ has been agreed.

Jim Reid, strategist at Deutsche Bank, says there is “perhaps a little disappointment” that we don’t have more details of the agreement, telling clients:

The main details came from Commerce Secretary Lutnick, who said that “We do absolutely expect that the topic of rare earth minerals and magnets” will be resolved and that export controls implemented by the US should come down as China approves relevant export licenses.

China’s trade representative Li Chenggang said that the US and Chinese delegations will now take the proposal back to their respective leaders, with Lutnick noting that “once the presidents approve it, we will then seek to implement it”.

At the same time, there was no evidence of progress on topics such as the fentanyl-related 20% tariffs on China that the US has implemented since February. So while the mood music has stayed positive, investors may be wary of the pattern that emerged during the previous US-China trade talks in 2018-19, when apparently constructive in person meetings seemed to take a step back as the negotiating teams returned to their capitals.

So there’s perhaps a little disappointment this morning that we haven’t yet got a bigger announcement, even though there’s time to hear the full conclusions of the meeting.

Chris Weston, head of research at brokerage Pepperstone, agrees that “the devil will be in the details”, adding:

“The details matter, especially around the degree of rare earths bound for the US, and the subsequent freedom for US produced chips to head East, but for now as long as the headlines of talks between the two parties remain constructive, risk assets should remain supported.”

Lin Gengwei, CEO of Rain Tree Partners in Singapore, called the agreement a “temporary achievement”, adding:

“The U.S. will not completely remove restrictions on chip exports to China, but may relax the curbs in response to pressure from both Beijing and the domestic semiconductor sector.”

Zeng Wenkai, chief investment officer at Shengqi Asset Management in Hong Kong, suggests more countries should stand up to the US in trade discussions:

“The market likely anticipated this — Trump is just TACO (Trump always chickens out).”

“Look at how countries are negotiating with the U.S. these days; it’s no longer like how Vietnam approached things early on. Japan and South Korea are taking a tougher stance. People have realised that kneeling gets you nowhere — in fact, it only invites more bullying.”

Tony Sycamore, market analyst at IG, says the US and China have found a way to quell trade tensions which risked spiralling out of control last week.

“If we keep the terms of the Geneva Agreement, we’re looking at US tariffs on Chinese goods staying at 30% for a period of time and Chinese tariffs on US goods at 10%. So that’s down from 145% and 125% respectively. That would be fantastic.

Introduction: US and China agree to framework deal to restore trade war truce

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

“Jaw, jaw is better than war, war,” as Harold Macmillan once remarked. And after two days of talking in London, the US and China have managed to patch up their trade conflict truce.

Just before midnight last night the two countries agreed a framework that, it is hoped, will ease tensions between the two economic superpowers. It will reinforce their initial agreement made in Geneva a month ago, once presidents Donald Trump and Xi Jinping have approved it.

Speaking at Lancaster House last night, US commerce scretary Howard Lutnick said the trade framework and implementation plan agreed with China in London should result in restrictions on rare earths and magents being resolved.

That had been a key demand for the US side, worried that American companies were being starved of vital supplies.

Lutnick told reporters the US negotiating team will take the framework back to Trump to get his approval, and then hope to implement it.

Lutnick says they had to get the “negativity out” first when it comes to the US-China trade relationship.

“It's been President Trump's fundamental goal to reduce the trade deficit and increase trade. So this was the first step that the framework by which we will then approach…

China’s vice commerce minister Li Chenggang described the talks as “rational and candid”, telling reporters:

“The two sides have, in principle, reached a framework for implementing the consensus reached by the two heads of state during the phone call on June 5th and the consensus reached at the Geneva meeting.”

The talks, which began on Monday morning, took longer than expected – with the two sides sustained by deliveries from restaurant chain Ottolenghi, McDonald’s, Burger King and KFC.

Investors are now waiting for details of the agreement, and confirmation that it will satisfy Xi and Trump.

Traders are also anticipating the latest US inflation report, which may show that the trade war has driven up prices in the shops. Economists predict the US CPI index will have risen to 2.5%, from 2.3%.

While in London, chancellor Rachel Reeves will deliver the government’s spending review, outlining day-to-day departmental spending for the next three years.

The agenda

-

12pm BST: US weekly mortgage applications data

-

12.30pm BST: Chancellor Rachel Reeves to deliver UK spending review

-

1.30pm BST: US inflation report for May

.png) 3 months ago

44

3 months ago

44