Key events Show key events only Please turn on JavaScript to use this feature

The oil price has nudged higher this morning, as the Israel-Iran conflict enters its seventh day.

Traders may be uncertain how the clashes will play out, after Donald Trump said he has not decided whether or not to take his country into the war, after he demanded Iran’s ‘unconditional surrender’ yesterday.

The president has suggested to defence officials it would make sense for the US to launch strikes against Iran only if the so-called “bunker buster” bomb was guaranteed to destroy a critical uranium enrichment facility, according to people familiar with the deliberations:

Brent crude is up 0.2% this morning at $76.86 per barrel. That’s more than 10% higher than at the start of last week, although below the initial spike last Friday when the attacks began.

Will Bank policymakers split again?

The Bank of England’s policymakers may not be united today over how to proceed.

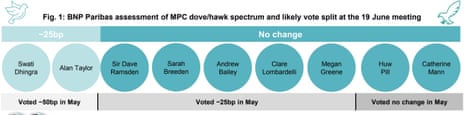

Last month, the BoE’s interest rate-setting committee split three ways, with two members opposing a cut to rates and two more pushing for a larger cut than was actually agreed by the majority.

BNP Paribas predicts the Bank will split 7-2, with the dovish Swati Dhingra and Alan Taylor in a minority voting for another cut.

They told clients:

Elevated trade uncertainty, limited clarity on the passthrough of domestic fiscal policy, and market pricing for a rate hold all point to a decision to keep rates on hold in June, in our view.

However, it is the divergence in domestic data in particular that will keep the MPC glued to its quarterly pace of easing for at least another meeting, we think.

Introduction: Bank of England expected to leave interest rates on hold today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

These are challenging times for central bankers. After steering through the Covid-19 pandemic, and then the energy shock after the Russia-Ukraine war, they must now set monetary policy in the face of an unpredictable trade war, and conflict in the Middle East.

Faced with such uncertainty, the Bank of England is expected to sit on its hands today when it sets UK interest rates.

According to the money markets, there’s a 96% chance that the BoE leaves rates on hold at 4.25% at noon today, and only a 4% possibility of a quarter-point cut (which would bring Bank Rate down to 4%).

Although UK inflation fell last month, to 3.4%, it remains stubbornly above the BoE’s 2% target – and could push higher if the Israel-Iran conflict drives the oil price higher.

Zara Nokes, global market analyst at J.P. Morgan Asset Management (JPMAM), says UK inflation is still “uncomfortably high”, explaining:

Escalating tensions in the Middle East, and the upward pressure this is putting on oil prices, will only add to the Bank of England’s concern about easing rates too quickly.

The Monetary Policy Committee will face a tougher choice when meeting again in August, given the combination of still-sticky inflation and evidence that the labour market is quite clearly cooling. A deterioration in the labour market should, in theory, put downward pressure on inflation, but until there are clear signs of this in the hard data, the Bank should be careful not to claim victory over inflation quite yet, not least because of the uncertain geopolitical climate.”

The Bank has cut rates four times in the last year, having lifted borrowing costs through 2022 and 2023 as it battled inflation. The money markets currently predict it will manage two more quarter-point cuts by the end of 2025.

Last night, America’s central bank left US interest rates on hold, but also lowered its forecasts for economic growth.

Federal Reserve chair Jerome Powell warned that the tariffs imposed by Donald Trump on imports would add to inflationary pressures, saying:

“Increases in tariffs this year are likely to push up prices and weigh on economic activity.

The effects on inflation could be short-lived, reflecting a one-time shift in the price level. It’s also possible that the inflationary effects could be more persistent.”

The UK’s new trade deal with the US should mean Britain is less affected by the global trade war, but as an open economy it would still feel the knock-on impact of trade disruption.

That could mean higher prices, meaning less pressure to cut rate, or lower growth, requiring lower borrowing costs to stimulate

The agenda

-

8.30am BST: Swiss National Bank interest rate decision

-

9am BST: Norges Bank interest rate decision

-

Noon BST: Bank of England interest rate decision

-

Noon BST: Bank of Turkey interest rate decision

.png) 2 months ago

28

2 months ago

28