Introduction: Will Bank of England cut QT bond sales today?

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

All eyes are on the Bank of England today as it prepares to announce its latest monetary policy decision at noon UK time, but for once interest rates are not on everyone’s mind.

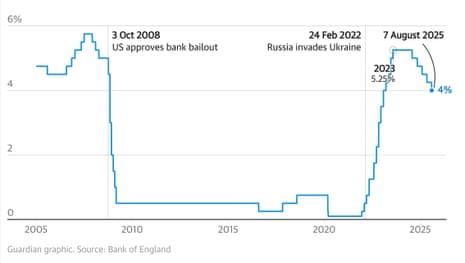

The BoE is widely expected to leave Bank Rate unchanged at 4%, a day after UK inflation remained painfully high over its target at 3.8%.

The real interest is whether it adjusts its bond-selling programme, giving a helping hand to chancellor Rachel Reeves.

Under that “quantitative tightening” (QT) programme, the Bank has been selling some of the government bonds it bought during the financial crisis and the Covid-19 pandemic. QT has come under growing criticism for pushing up borrowing costs -- as the Bank’s steady selling has weighed on bond prices, which lifts bond yields.

The Bank is due to make its annual assessment of QT today, and many City economists expect it to slow the unwinding process.

Over the last months, the Bank conducted £100bn of QT, through active sales and by not replacing bonds as they mature. Economists are expecting policymakers will slow the pace of reduction in gilts to around £72bn.

A slowdown in gilt sales would help Reeves by easing the pressure on elevated gilt yields, which hit a 27-year high last month. Lower yields could help give the chancellor some headroom in her autumn budget calculations.

Laith Khalaf, head of investment analysis at AJ Bell, says:

“The gilts held by the Bank of England have turned from making a tidy profit for the government into a costly expense now interest rates have risen and the Quantitative Easing (QE) programme is being slowly unwound.

In essence, we are now paying for the cost of the extraordinary stimulus provided by the Bank of England in the wake of the financial crisis, which started over 16 years and eight chancellors ago. Rachel Reeves is in the unfortunate position of being the mug now holding the enormous bill to present to the taxpayer.

Last night, the Federal Reserve cut US interest rates for the first time this year, responding to signs that America’s jobs market is weakening.

The agenda

-

9am BST: Norges Bank to set Norwegian interest rates

-

Noon BST: Bank of England monetary policy decision

-

1.30pm BST: US weekly jobless claims data

Key events Show key events only Please turn on JavaScript to use this feature

It would be a big shock for the City if the Bank of England doesn’t leave interest rates on hold at midday at 4%.

The money markets are indicating there’s a 97% chance of ‘no change’, and just a 3% possibility of a hike back to 4.25%.

Last month, the Bank’s nine policymakers were badly split – with four voting to hold rates at 4.25%, four favouring a cut to 4%, and one initially plumping for a large cut to 3.75%, before joining the ‘smaller cut’ gang in a second vote.

Introduction: Will Bank of England cut QT bond sales today?

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

All eyes are on the Bank of England today as it prepares to announce its latest monetary policy decision at noon UK time, but for once interest rates are not on everyone’s mind.

The BoE is widely expected to leave Bank Rate unchanged at 4%, a day after UK inflation remained painfully high over its target at 3.8%.

The real interest is whether it adjusts its bond-selling programme, giving a helping hand to chancellor Rachel Reeves.

Under that “quantitative tightening” (QT) programme, the Bank has been selling some of the government bonds it bought during the financial crisis and the Covid-19 pandemic. QT has come under growing criticism for pushing up borrowing costs -- as the Bank’s steady selling has weighed on bond prices, which lifts bond yields.

The Bank is due to make its annual assessment of QT today, and many City economists expect it to slow the unwinding process.

Over the last months, the Bank conducted £100bn of QT, through active sales and by not replacing bonds as they mature. Economists are expecting policymakers will slow the pace of reduction in gilts to around £72bn.

A slowdown in gilt sales would help Reeves by easing the pressure on elevated gilt yields, which hit a 27-year high last month. Lower yields could help give the chancellor some headroom in her autumn budget calculations.

Laith Khalaf, head of investment analysis at AJ Bell, says:

“The gilts held by the Bank of England have turned from making a tidy profit for the government into a costly expense now interest rates have risen and the Quantitative Easing (QE) programme is being slowly unwound.

In essence, we are now paying for the cost of the extraordinary stimulus provided by the Bank of England in the wake of the financial crisis, which started over 16 years and eight chancellors ago. Rachel Reeves is in the unfortunate position of being the mug now holding the enormous bill to present to the taxpayer.

Last night, the Federal Reserve cut US interest rates for the first time this year, responding to signs that America’s jobs market is weakening.

The agenda

-

9am BST: Norges Bank to set Norwegian interest rates

-

Noon BST: Bank of England monetary policy decision

-

1.30pm BST: US weekly jobless claims data

.png) 1 month ago

38

1 month ago

38