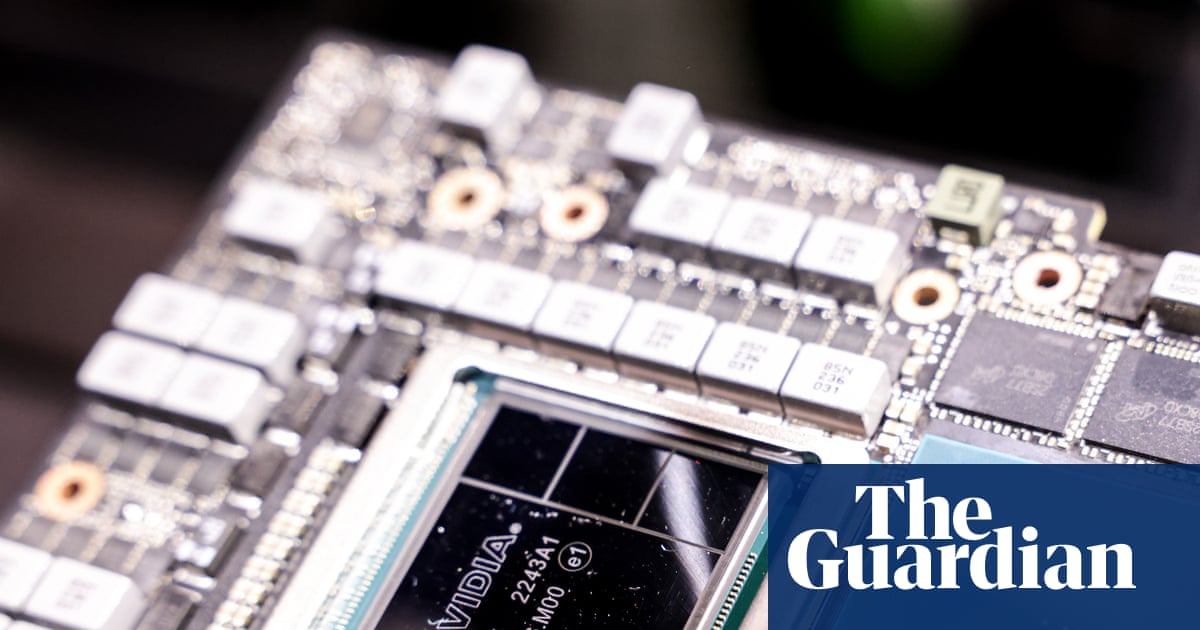

Carmakers in the EU are “days away” from closing production lines, the industry has warned as a crisis over computer chip supplies from China escalates.

The European Automobile Manufacturers’ Association (ACEA) issued an urgent warning on Wednesday saying its members, which include Volkswagen, Fiat, Peugeot and BMW, were now working on “reserve stocks but supplies are dwindling”.

“Assembly line stoppages might only be days away. We urge all involved to redouble their efforts to find a diplomatic way out of this critical situation,” said its director general, Sigrid de Vries.

Another ACEA member, Mercedes, is now searching globally for alternative sources of the crucial semiconductors, according to its chief executive, Ola Källenius.

The chip shortage is also causing problems in Japan, where Nissan’s chief performance officer, Guillaume Cartier, told reporters at a car show in Tokyo that the company was only “OK to the first week of November” in terms of supply.

Beijing banned exports of Nexperia chips near the start of the month in response to the Dutch government’s decision to take over the Netherlands-headquartered company on 30 September and suspend its Chinese chief executive after the US flagged security concerns.

Last week car companies in the UK, EU and Japan, including brands such as Volvo, Volkswagen, Honda and Nissan, said the ban on exports from Nexperia factories in China could halt production lines.

“The industry is currently working through reserve stocks but supplies are rapidly dwindling. From a survey of our members this week, some are already expecting imminent assembly line stoppages,” de Vries said.

The Nexperia chip ban was a blow to Europe’s car sector, which has already been hit by President Xi Jinping’s decision to reintroduce controls on exports of rare earth exports as part of the escalating trade tensions with the US.

Xi and Donald Trump are expected to sign off on a trade agreement when they meet on the sidelines of a summit in South Korea on Thursday. The proposed deal would pause the export ban on the crucial minerals for a year, but it is unclear if this will also cover deliveries to the EU.

Rare earths, in particular magnets, are used across the car industry for window, door and boot openings, while chips are critical to all electronics in vehicles, ranging from dashboard functions to ignition and transmission systems.

De Vries said while alternative suppliers for chips existed, it could take “months to build up additional capacity”. She said the “industry does not have that long before the worst effects of this shortage are felt”.

A high-level delegation from Beijing will arrive in Brussels on Friday for talks but there are fears the diplomatic tools deployed by the EU in the past months are not as effective as the hardballing used by the US and China.

“We know that all parties to this dispute are working very hard to find a diplomatic solution. At the same time, our members are telling us that part supplies are already being stopped due to the shortage,” de Vries said.

The Dutch government seized control of Nexperia on 30 September, citing lapses in governance. On 4 October, the Chinese ministry of commerce blocked exports of the chipmaker’s products out of China. While most of Nexperia’s semiconductors are produced in Europe, about 70% are packaged in China before distribution.

The company’s Chinese arm has taken steps toward independence and has resumed selling products to domestic Chinese customers.

The sources said the Dutch government believes it can negotiate a resolution with China that will restore the company to a unified Dutch-Chinese structure.

.png) 4 hours ago

8

4 hours ago

8