UK house prices return to growth in September

UK house prices returned to growth last month, lender Nationwide reports this morning.

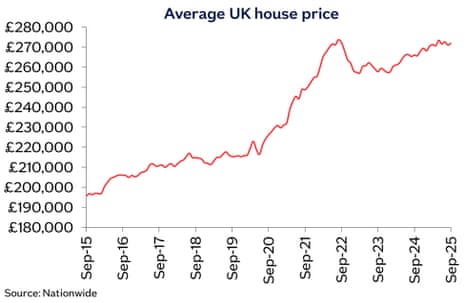

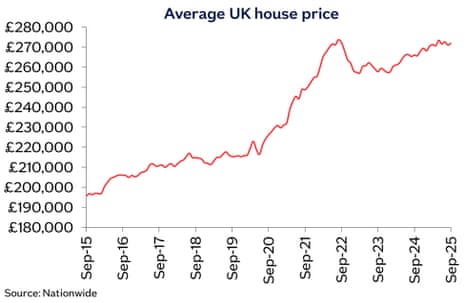

According to Nationwide, the average UK house price rose by 0.5% in September, having dropped by 0.1% in August, lifting the average price to £271,995.

On an annual basis, house prices rose by 2.2% in the year to September, up from 2.1% in August.

Robert Gardner, Nationwide’s chief economist, says ‘supportive’ conditions for buyers are supporting the market:

“The broad stability in the annual rate of house price growth over the past three months mirrors that of activity. The number of mortgages approved for house purchase have been hovering at around 65,000 cases per month, close to the pre-pandemic average (despite the higher interest rate environment).

“Despite ongoing uncertainties in the global economy, underlying conditions for potential home buyers in the UK remain supportive.

“Unemployment is low, earnings are rising at a healthy pace, household balance sheets are strong and borrowing costs are likely to moderate a little further if Bank Rate is lowered in the coming quarters as we, and most other analysts, expect.

“Providing the broader economic recovery is maintained, housing market activity is likely to strengthen gradually in the quarters ahead.

Key events Show key events only Please turn on JavaScript to use this feature

Housebuilder Taylor Wimpey reports drop in sales rate

Elsewhere in the property sector, UK homebuilder Taylor Wimpey has revealed its sales rate has slowed over the summer.

Taylor Wimpey has reported that in the nine weeks to 28 September 2025, its net private sales rate was 0.65 per outlet per week.

That’s slower than a year earlier (when it sold 0.7 homes per outlet per week), and below its sales rate for the year to date of 0.74 per outlet per week.

Taylor Wimpey points to “the backdrop of softer market conditions”, but insists that its expectations for full year operating profit are unchanged, adding:

While mindful of the various issues impacting customer sentiment and propensity to buy homes, including the impact of the delayed UK Budget on short term customer confidence, we remain well positioned and own all land with planning for 2026 completion.

Southern England lags behind rest of the market

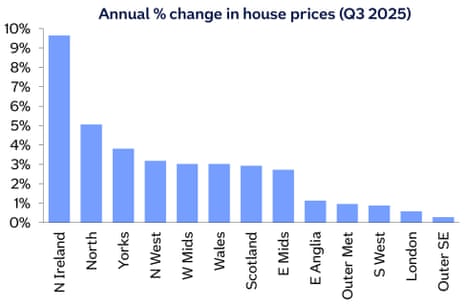

Nationwide also reports there was a modest slowdown in annual house price growth in the the majority of regions across the UK in the last quarter.

Northern Ireland remained the top performing area with annual house price growth of 9.6% in the July-September quarter, followed by Wales with 3.0% annual growth, Scotland with 2.9%, then England with 1.6%.

In @AskNationwide's latest house price index for September average house price growth nudged up by 0.5%. This made the average home now worth £271,995 according to their index. Once again Northern Ireland and the North continued to outperform the rest of the country boosting… pic.twitter.com/2BtQTx570e

— Emma Fildes (@emmafildes) October 1, 2025Prices rose faster in Northern England than the South, Nationwide explains:

Average prices in Northern England (comprising North, North West, Yorkshire & The Humber, East Midlands and West Midlands) were up 3.4% year on year, with the North (which incorporates areas, such as Tyneside, Teesside and Cumbria) the top performing region in England – with prices up 5.1% year on year.

Meanwhile average house price growth in Southern England (South West, Outer South East, Outer Metropolitan, London and East Anglia) slowed to 0.7%. This was driven by a marked softening in price growth in Outer Metropolitan and Outer South East, the latter being the weakest performing region, with annual growth of 0.3% (down from 2.6% last quarter).

UK house prices return to growth in September

UK house prices returned to growth last month, lender Nationwide reports this morning.

According to Nationwide, the average UK house price rose by 0.5% in September, having dropped by 0.1% in August, lifting the average price to £271,995.

On an annual basis, house prices rose by 2.2% in the year to September, up from 2.1% in August.

Robert Gardner, Nationwide’s chief economist, says ‘supportive’ conditions for buyers are supporting the market:

“The broad stability in the annual rate of house price growth over the past three months mirrors that of activity. The number of mortgages approved for house purchase have been hovering at around 65,000 cases per month, close to the pre-pandemic average (despite the higher interest rate environment).

“Despite ongoing uncertainties in the global economy, underlying conditions for potential home buyers in the UK remain supportive.

“Unemployment is low, earnings are rising at a healthy pace, household balance sheets are strong and borrowing costs are likely to moderate a little further if Bank Rate is lowered in the coming quarters as we, and most other analysts, expect.

“Providing the broader economic recovery is maintained, housing market activity is likely to strengthen gradually in the quarters ahead.

Introduction: Markets put strong September behind them

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

It’s a new month in the markets, as investors shuffle nervously into the final quarter of the year.

September, often a weak month in the markets, was surprisingly strong this year despite anxiety that the artificial intelligence boom had run too high. Global stocks climbed by 3.5%, their best September since 2013, while the US S&P 500 share index had its best September in fifteen years.

Britain’s FTSE 100 joined the party, hitting a record closing high of 9350 points last night.

October is starting with the news that the US government is in shutdown, after Republicans and Democrats failed to agree a funding plan for federal departments.

Investors don’t seem too alarmed yet, probably remembering that previous shutdown have been resolved fairly quickly. However, they will be deprived of US economic data until the situation is resolved.

The uncertainty appears to be weighing on the US dollar. The dollar index has slipped to a one-week low, lifting the pound by 0.15% to $1.345. The euro has also strengthened.

Gold, which doesn’t need any excuse to rise this year, has hit a new record high of $3,875 early this morning as the shutdown loomed.

Typically, “a shutdown is immaterial for markets”, points out Kyle Rodda, senior financial market analyst at capital.com, adding:

In fact, the 2018-2019 shutdown, which lasted for over a month, actually saw Wall Street rise. The issue for markets here is twofold.

One, it could delay the release of Friday’s Non-Farm Payrolls data, which is going to be a nuisance, if nothing else, especially as market participants search for insights on the health of an ailing US labour market.

US President Trump has also threatened to permanently lay-off workers, which could turn the shutdown into a mini labour market shock.

The agenda

-

7am BST: Nationwide’s UK house price index

-

9am BST: Eurozone manufacturing PMI report for September

-

9.30am BST: UK manufacturing PMI report for September

-

10am BST: Eurozone inflation report for September

.png) 1 month ago

30

1 month ago

30