Bank of England interest rate decision

Newsflash: The Bank of England has cut UK interest rates for a second time this year.

As City experts had predicted (see opening post), the Bank’s monetary policy committee have voted to lower Bank Rate by a quarter of one percentage points, down from 5% to 4.75%.

It’s the second cut this year, following August’s reduction, and comes after inflation fell below its 2% target in September.

The Bank will have made the decision having assessed last week’s UK government budget and Donald Trump’s election as US president.

Key events Show key events only Please turn on JavaScript to use this feature

Larry Elliott applauded off the pitch

Onto questions, and the first goes to my esteemed colleague Larry Elliott.

Q: Is the message from this report that interest rates will stay higher for longer because of the budget?

Andrew Bailey begins with a tribute to Larry, who is stepping down from his role of Guardian economics editor this month.

The governor says:

“We all want to join together and thank you for everything you’ve done for British economics journalism, and wish you all the best for the future. It’s been a pleasure working with you.

Larry then gets a round of applause – a rare event at these press conferences.

As Bailey points out:

You are of course the first person ever to get applause in this press conference, because we will never.

Larry fans shouldn’t get too despondent (although I am) as he’ll still be writing his fortnightly column.

Onto the question, and Bailey points out that the Bank did cut rates today having seen the budget.

There is some upward effect on inflation, but the path of inflation – we think – returns to the target by the horizon.

Bailey: How employers might respond to NICs increase

There are different ways the increase in employers’ national insurance contributions announced in the budget could play out in the economy, BoE governor Andrew Bailey says.

It increases the cost of employment, he explains, and there are at least four potential margins of adjustments

-

Firms could pass it on through higher prices paid by consumers

-

They could absorb it through lower profit margins or higher productivity

-

firms could increase wages by less than they would otherwise

-

They could reduce employment.

Bailey won’t opine on the policy itself, but the Bank must respond to its consequences on inflation, he says.

On the budget, Bailey says overall, fiscal policy is still expected to tighten over the next few years.

But, the measures announced last week will reduce the amount of spare capacity in the economy, he adds, before outlining how budget measures will add 0.5 percentage points to inflation at its peak.

Interestingly, the Bank’s forecasts assume that fuel duty will push up inflation from the second quarter of 2026, even though chancellor Rachel Reeves froze it last week.

Governor Andrew Bailey then explains that the Bank must assess whether the remaining inflation pressures, which manifest in services price inflation and wage growth, will dissipate as global shocks unwind, or not.

Bank begins press conference

The Bank of England are holding a press conference now to discuss today’s decision to cut interest rates. You can watch it here.

Governor Andrew Bailey is explaining that inflation has fallen more than expected over the last year.

Oil and gas prices have been significantly lower than expected a year ago, he points out. Lower than expected food, core goods and services prices inflation has also pulled inflation down.

But, he adds that inflation is “expected to rise somewhat” in coming months, to around 2.5% by the end of the year.

The pound has risen since the Bank of England’s announcement.

Stertling is up almost 0.5% today at $1.294 against the dollar, up from $1.29 just before noon when the rate decision – and the Bank’s latest forecasts – were released.

Bank: Budget will add to inflation, and growth

The Bank of England has calculated that Rachel Reeves’s budget last week will fuel inflation, but also lift the UK’s growth rate.

In its latest Monetary Policy Report, released at noon, the Bank says that measures such as a higher cap of £3 on bus fares, adding VAT on private school fees, and the increase in Vehicle Excise Duty from April, will push up the cost of living measure.

It estimates that the Budget is will boost CPI inflation (which was 1.7% in September) by just under ½ of a percentage point at the peak, “reflecting both the indirect effects of the smaller margin of excess supply and direct impacts from the Budget measures”.

The increase in employer NICs is also assumed to have a small upward impact on inflation.

The Bank explains:

In the near term, the direct effects of the rise in the cap on single bus fares from £2 to £3 and the introduction of VAT on private school fees from January, and the increase in Vehicle Excise Duty from April, push up the MPC’s projection for CPI inflation from 2025 Q1 and Q2.

The measures announced in the autumn budget are also expected to boost the level of GDP by around 0.75% at their peak in a year’s time, relative to the Bank’s August projections.

Bank: gradual approach to removing policy restraint remains appropriate

The Bank of England says it is appropriate to take a “gradual approach to removing policy restraint” – ie, cutting interest rates.

The minutes of this week’s meeting say:

Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.

The Committee continues to monitor closely the risks of inflation persistence and will decide the appropriate degree of monetary policy restrictiveness at each meeting.

Bank split 8-1 on rate cut

Policymakers weren’t quite unanimous in deciding to cut UK interest rates today.

The Bank’s MPC voted by a majority of 8–1 to reduce Bank Rate by 0.25 percentage points, to 4.75%.

One member – the hawkish Catherine Mann – preferred to maintain Bank Rate at 5%, but was outvoted.

The Bank says:

At this meeting, eight members preferred to reduce Bank Rate to 4.75%. There had been continued progress in disinflation, particularly as previous external shocks had abated, although remaining domestic inflationary pressures were resolving more slowly. These members put different probabilities on and risks around the three cases, but they believed that a cut in Bank Rate was appropriate at this meeting. They would continue to assess the range of evidence over time.

One member preferred to maintain Bank Rate at 5%. For this member, structural factors in wage and price-setting dynamics continued to draw out the underlying disinflation process, and CPI inflation was projected to remain above the 2% target until the end of the forecast period.

Wage developments might continue to be more robust than projected as firms and workers incorporated past and upcoming adjustments in the National Living Wage and National Insurance contributions. This, along with prospects for more robust demand associated with the Budget, was likely to support pricing opportunities for firms. In the face of these uncertainties, maintaining the current level of Bank Rate would allow time to evaluate whether these upside pressures would materialise.

Bank of England interest rate decision

Newsflash: The Bank of England has cut UK interest rates for a second time this year.

As City experts had predicted (see opening post), the Bank’s monetary policy committee have voted to lower Bank Rate by a quarter of one percentage points, down from 5% to 4.75%.

It’s the second cut this year, following August’s reduction, and comes after inflation fell below its 2% target in September.

The Bank will have made the decision having assessed last week’s UK government budget and Donald Trump’s election as US president.

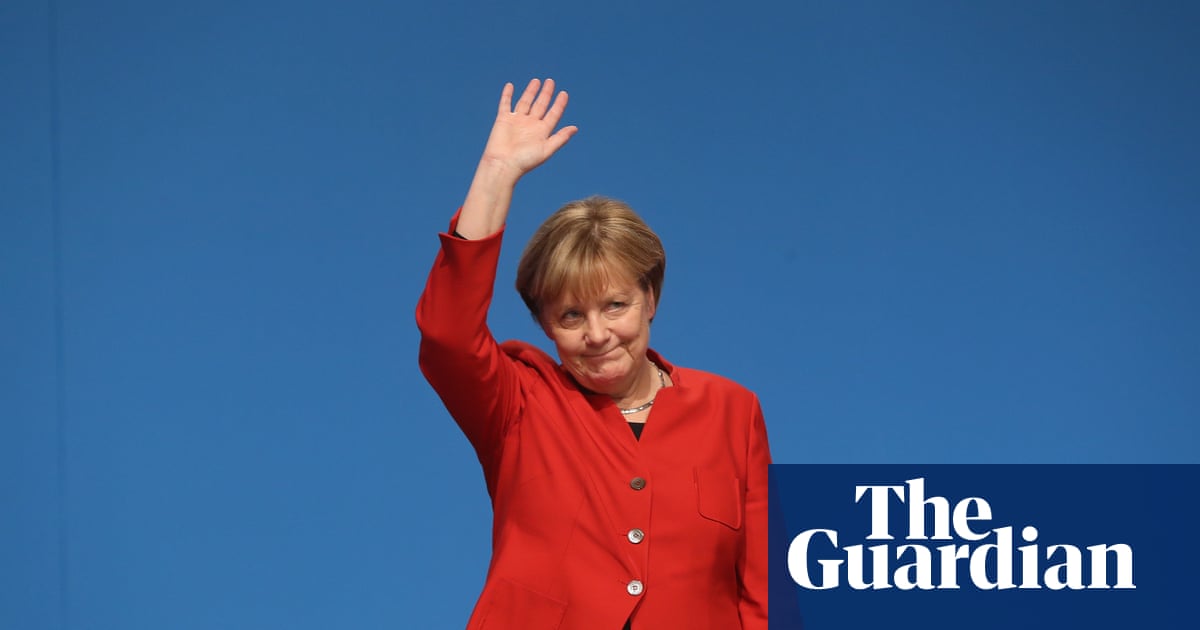

European leaders have urged Donald Trump to avoid trade wars, maintain support for Ukraine and to refrain from unsettling the global order, as they arrive in Budapest for a meeting.

Reuters has the details:

“I trust the American society,” European Council chief Charles Michel said as he and others urged Trump to continue to support Ukraine, as they arrived at a meeting of nearly 50 European leaders in Budapest.

“They know it is in their interest to show firmness when we engage with authoritarian regimes. If the United States were weak with Russia, what would it mean for China?”

European Commission chief Ursula von der Leyen said it was now up to the European Union to be united. No EU member state on their own can manage the upcoming challenges, she said.

German government bonds are weakening today, following the collapse of its coalition government last night when Chancellor Olaf Scholz fired finance minister Christian Lindner.

With prices falling, the yield – or rate of return – on 10-year German bunds has risen by around 9 basis points, from 2.396% to 2.483%.

That narrows the gap (slightly) between German and UK debt; 10-year gilts are yielding 4.54% this morning.

Scholz said he had dismissed Lindner after he refused to suspend rules limiting new government borrowing. If that debt brake were lifted, Germany could issue more bonds.

.png) 2 months ago

15

2 months ago

15