Entry-level workers face ‘job-pocalypse’ due to AI

Entry-level workers are facing a ‘job-pocalypse’ due to companies favouring artificial intelligence systems over new hires, a new study of global business leaders shows.

A new report by the British Standards Institution (BSI) has found that business leaders are prioritising automation through AI to fill skills gaps, in lieu of training for junior employees.

The BSI polled more than 850 bosses in Australia, China, France, Germany, Japan, the UK, and the US, and found that 41% said AI is enabling headcount reductions. Nearly a third of all respondents reported that their organization now explores AI solutions before considering hiring a human.

Two-fifths of leaders revealed that entry-level roles have already been reduced or cut due to efficiencies made by AI conducting research, admin and briefing tasks, and 43% expect this to happen in the next year.

Susan Taylor Martin, CEO of BSI says:

“AI represents an enormous opportunity for businesses globally, but as they chase greater productivity and efficiency, we must not lose sight of the fact that it is ultimately people who power progress.

Our research makes clear that the tension between making the most of AI and enabling a flourishing workforce is the defining challenge of our time. There is an urgent need for long-term thinking and workforce investment, alongside investment in AI tools, to ensure sustainable and productive employment.”

Worryingly for those trying to enter the jobs market, a quarter of business leaders said they believe most or all tasks done by an entry-level colleague could be performed by AI.

A third suspect their own first job would not exist today, due to the rise of artificial intelligence tools.

And… 55% said they felt that the benefits of implementing AI in organizations would be worth the disruptions to workforces.

These findings will add to concerns that graduates face a workforce crisis as they battle AI in the labour market. A poll released in August found that half of UK adults fear AI will change, or eliminate, their jobs.

Telecoms firm BT is replacing about 10,000 jobs with AI systems, as part of a wider workforce reduction programme.

Key events Show key events only Please turn on JavaScript to use this feature

Business leaders may be ‘pulling up the ladder’ behind them, by focusing on AI tools rather than taking on new staff, warns Kate Field, global head human and social sustainability at the BSI.

Field explains:

“As roles are streamlined or eliminated before experience can be gained, we risk eroding the professional aspirations of people at the very start of their careers and before they’ve had the chance to flourish.

Our findings suggest a troubling trend: senior leaders may be ‘pulling up the ladder’, prioritizing short-term productivity over long-term workforce resilience. If left unchecked, this could have lasting consequences, from weakening our skills pipeline, deepening generational inequality and our research suggests, dividing large companies and SMEs.

SMEs have been placed in a critical position, shaping the future of work by shouldering the responsibility of training for Gen Z.”

The BSI’s poll of global business leaders also found that large organizations are embracing AI more aggressively compared with SMEs.

It says:

Half (51%) of the respondents working in SMEs say AI is crucial to the growth of their organization, compared with nearly seven in ten respondents in large organizations (69%). This is reflected in its impact being felt; 70% of large businesses reported AI saves money compared to just half of SMEs (51%).

Entry-level workers face ‘job-pocalypse’ due to AI

Entry-level workers are facing a ‘job-pocalypse’ due to companies favouring artificial intelligence systems over new hires, a new study of global business leaders shows.

A new report by the British Standards Institution (BSI) has found that business leaders are prioritising automation through AI to fill skills gaps, in lieu of training for junior employees.

The BSI polled more than 850 bosses in Australia, China, France, Germany, Japan, the UK, and the US, and found that 41% said AI is enabling headcount reductions. Nearly a third of all respondents reported that their organization now explores AI solutions before considering hiring a human.

Two-fifths of leaders revealed that entry-level roles have already been reduced or cut due to efficiencies made by AI conducting research, admin and briefing tasks, and 43% expect this to happen in the next year.

Susan Taylor Martin, CEO of BSI says:

“AI represents an enormous opportunity for businesses globally, but as they chase greater productivity and efficiency, we must not lose sight of the fact that it is ultimately people who power progress.

Our research makes clear that the tension between making the most of AI and enabling a flourishing workforce is the defining challenge of our time. There is an urgent need for long-term thinking and workforce investment, alongside investment in AI tools, to ensure sustainable and productive employment.”

Worryingly for those trying to enter the jobs market, a quarter of business leaders said they believe most or all tasks done by an entry-level colleague could be performed by AI.

A third suspect their own first job would not exist today, due to the rise of artificial intelligence tools.

And… 55% said they felt that the benefits of implementing AI in organizations would be worth the disruptions to workforces.

These findings will add to concerns that graduates face a workforce crisis as they battle AI in the labour market. A poll released in August found that half of UK adults fear AI will change, or eliminate, their jobs.

Telecoms firm BT is replacing about 10,000 jobs with AI systems, as part of a wider workforce reduction programme.

HSBC drags FTSE 100 down

The London stock market is in the red this morning, pulled down by banking giant HSBC.

The FTSE 100 has dropped by 30 points, or 0.3%, to 9518, a day after hitting a record high.

HSBC has dropped by 6%, after it announced plans to take full control of Hong Kong’s Hang Seng Bank, in which it already owns a controlling shareholding.

ICAEW: UK business confidence in freefall

UK business confidence has dropped to a three-year low as companies fret about higher taxes, a new poll has shown.

ICAEW’s business sentiment has dropped to -7.3 for the third quarter of 2025, down from -4.2 in April-June.

That’s the fifth consecutive quarterly fall in a row, and the lowest level since the last three months of 2022.

ICAEW explains:

This drop in confidence was likely driven by record high tax concerns squeezing profits growth, recruitment and investment activity.

Muted domestic sales growth also weighed on sentiment, as firms continue to lower their expectations for the year ahead.”

Lloyds shares drop as additional motor finance costs loom

Shares in Lloyds Bank have dropped by 3.5% at the start of trading in London, after it warned shareholders it could face a larger financial hit from the UK motor finance scandal.

Lloyds told the City this morning that it may need to take an “additional provision” to cover the cost of the issue.

This follows the unveiling of a compensation scheme for motorists who bought cars via discretionary commission deals from 2007 to 2024, which could lead to average payouts of £700.

Lloyds says:

As previously noted, the Group continues to consider the impact and implications of the recently published FCA consultation paper on motor finance. Uncertainties remain outstanding on the interpretation and implementation of the proposals but based on our initial analysis and the characteristics of the proposed scheme, an additional provision is likely to be required which may be material.

This remains subject to ongoing analysis and review of the proposals. The Group will continue to update the market as and when appropriate.”

Lloyds shares have dropped to 84.5p.

JP Morgan's Dimon warns about risks of US stock market fall

The boss of JP Morgan has joined the choir of experts warning that a stock market tumble may be approaching.

Jamie Dimon has revealed he is concerned that the US stock market is overheated, and cautioned there could be a serious market correction, which he said could come in the next six months to two years.

Speaking to the BBC, Dimon said a “lot of things out there” are creating an atmosphere of uncertainty, such as geopolitical risks, government spending, and the remilitarisation of the world.

Dimon says:

All these things cause a lot of issues that we don’t know how to answer.

So I say the level of uncertainty should be higher in most people’s minds than what I would call normal.”

His comments come as the Bank of England warned of a growing risk of a “sudden correction” in global markets, citing concerns about soaring valuations of leading AI tech companies.

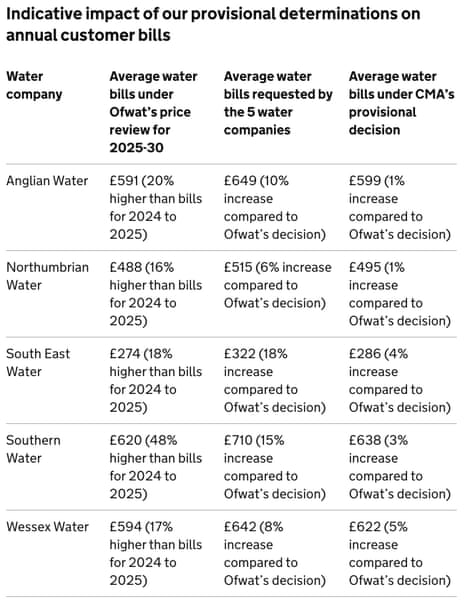

Table: How water bills will rise

Here’s a table showing the increase to water bills signed off by the CMA, in its “provisional redeterminations on water price controls”.

Britain’s risk of winter blackouts drops to five year low

Jillian Ambrose

From water to energy … and Britain’s risk of winter blackouts has fallen to its lowest level in five years, according to the energy system operator … but it won’t necessarily be affordable.

Forecasts by the National Energy System Operator (Neso) show that electricity supply margins – the amount of generation available above the expected levels of demand – could reach 10% this winter. This would be the healthiest margins since the winter of 2019-2020.

However, the healthier supplies are down to an increase in energy imports, meaning they could be more expensive if international markets demand higher prices.

The Neso report expects margins to be healthier in part due to the start up of the Greenlink interconnector which runs from Pembrokeshire in Wales to County Wexford in Ireland and which will import power when prices are higher in the UK than in Ireland.

The UK’s energy system also has a greater availability of gas plants this winter, after some returned from outage last winter, but this comes as the UK’s gas supply margins shrink to their lowest in four years as the North Sea’s production continues to dwindle.

Neso warned that the UK will need to rely more heavily on imports of gas via liquified natural gas (LNG) tankers, which typically come from the US and Qatar. National Gas, which runs the UK’s gas transmission network, expects the UK’s overall gas demand to be slightly lower this winter but added that it can expect 6% less gas from the UK North Sea this winter compared with last year. Instead, it will increase LNG imports by 7%, it said.

This raises the chance of higher gas costs if the market price continues to rise. In Europe, gas storage levels are slightly lower than in previous winters meaning more LNG imports could be needed in neighbouring markets, too.

Introduction: UK watchdog rejects 80% of water firms' price hike requests, but....

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Millions of households in England are to be hit with even higher water bill increases than previously planned, under plans being unveiled by the competition regulator this morning.

But the pain isn’t going to be as bad as the water companies had hoped.

The Competitions and Markets Authority has decided to approve around a fifth of spending increases proposed by water companies, on top of existing plans signed off by water regulator Ofwat, which will be funded by increases in bills.

And while it has “largely rejected” companies’ funding requests for new activities and projects, it is provisionally allowing 21% of the total £2.7bn requested by Anglian Water, Northumbrian Water, South East Water, Southern Water, and Wessex Water.

This means they can seek an extra £556m in revenue, which is expected to mean an average increase of 3% in bills for customers of the disputing companies.

That is on top of the 24% increase in bills for customers of these companies under Ofwat’s original determination, which companies had complained was too stingy.

The CMA says this extra money will fund more resilient supply, reduce pollution and also reflect increased financing costs.

Kirstin Baker, who chaired the group which examined the issue, says:

We’ve found that water companies’ requests for significant bill increases, on top of those allowed by Ofwat, are largely unjustified. We understand the real pressure on household budgets and have worked to keep increases to a minimum, while still ensuring there is funding to deliver essential improvements at reasonable cost.

The agenda

-

7am BST: German trade balance

-

9.30am BST: Economic activity and social change in the UK, real-time indicators from the ONS

-

9.30am BST: Bank of England policymaker Catherine Mann gives keynote speech at Resolution Foundation event

-

11am BST: Financial Conduct Authority annual public meeting

-

1.30pm BST: Federal Reserve chair Jerome Powell speaks

.png) 1 month ago

24

1 month ago

24