Introduction: UK wage growth falls to four-year low

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

There’s an autumnal chill settling on the UK economy, as businesses and consumers nervously anticipate Rachel Reeves’s November budget.

Salaries almost stagnated last month, new data shows, as companies reported weaker demand for workers and reduced hiring budgets.

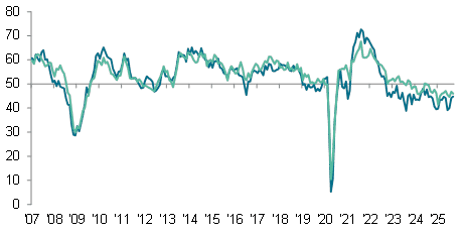

According to the latest KPMG and REC, UK Report on Jobs, starting pay for permanent workers rose “negligibly” in September, with wages rising at the weakest pace since the current run of pay inflation began just over four-and-a-half years ago.

That will fuel concerns that the increase in employers’ national insurance contribution rates have hammered hiring in sectors such as retail and hospitality.

The wage slowdown is clearly news for workers, but something which might reassure UK central bankers as they try to bring inflation, and inflation expectations, down.

Neil Carberry, chief executive of REC, says:

“Pay trends remain subdued where pay is set by the market rather than the Government. This suggests that pay growth should not be a drag on the Bank of England’s upcoming interest rate decision.”

The report also found that vacancy numbers across the UK continued to fall markedly at the end of the third quarter. And while demand for staff is falling, the number of candidates looking for a job is rising “rapidly”, it says.

Carberry explains:

“Recruiters have been reporting a trend towards stabilisation in the permanent job market since the summer, and today’s data back that up for September. The temporary market remains somewhat healthier, with growth in some regions.

We can hope that the jobs market and the economy may be moving towards calmer waters, but falling vacancies is a reminder that what is really needed is a shot of confidence in the wider economy to get things going.

The agenda

-

3pm BST: University of Michigan’s US consumer confidence index

Key events Show key events only Please turn on JavaScript to use this feature

Permanent placements decline again

Today’s KPMG and REC UK Report on Jobs survey also shows that the number of permanent placements fell again in September, but at the slowest rate in a year.

The report shows that firms often noted that employers were hesitant to take on new workers due to weaker economic conditions and cost concerns.

Jon Holt, group chief executive and UK senior partner at KPMG, says:

“With very little positive news out there on the economy in recent months, and lots of speculation about the Budget, it is understandable that employers are cautious with their hiring. But despite these headwinds, our annual CEO Outlook revealed this week that chief executives are more upbeat about future growth prospects for their industry and the UK economy than might be expected. They are resilient and responding to challenges by adapting their investment strategies to focus on AI adoption, managing cyber risk and upskilling their talent.

“The jobs market has not yet turned a corner and remains tough, but we saw stabilisation in some of the numbers last month. While the public finances provide little room for manoeuvre in November, some clear signals from the Chancellor that build on business confidence will hopefully support renewed hiring as we head into 2026.”

Introduction: UK wage growth falls to four-year low

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

There’s an autumnal chill settling on the UK economy, as businesses and consumers nervously anticipate Rachel Reeves’s November budget.

Salaries almost stagnated last month, new data shows, as companies reported weaker demand for workers and reduced hiring budgets.

According to the latest KPMG and REC, UK Report on Jobs, starting pay for permanent workers rose “negligibly” in September, with wages rising at the weakest pace since the current run of pay inflation began just over four-and-a-half years ago.

That will fuel concerns that the increase in employers’ national insurance contribution rates have hammered hiring in sectors such as retail and hospitality.

The wage slowdown is clearly news for workers, but something which might reassure UK central bankers as they try to bring inflation, and inflation expectations, down.

Neil Carberry, chief executive of REC, says:

“Pay trends remain subdued where pay is set by the market rather than the Government. This suggests that pay growth should not be a drag on the Bank of England’s upcoming interest rate decision.”

The report also found that vacancy numbers across the UK continued to fall markedly at the end of the third quarter. And while demand for staff is falling, the number of candidates looking for a job is rising “rapidly”, it says.

Carberry explains:

“Recruiters have been reporting a trend towards stabilisation in the permanent job market since the summer, and today’s data back that up for September. The temporary market remains somewhat healthier, with growth in some regions.

We can hope that the jobs market and the economy may be moving towards calmer waters, but falling vacancies is a reminder that what is really needed is a shot of confidence in the wider economy to get things going.

The agenda

-

3pm BST: University of Michigan’s US consumer confidence index

.png) 1 month ago

43

1 month ago

43