Introduction: Scott Bessent accuses China of trying to damage global economy

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Tensions between the US and China continue to swirl, even though fears of a renewed trade war cooled on Monday.

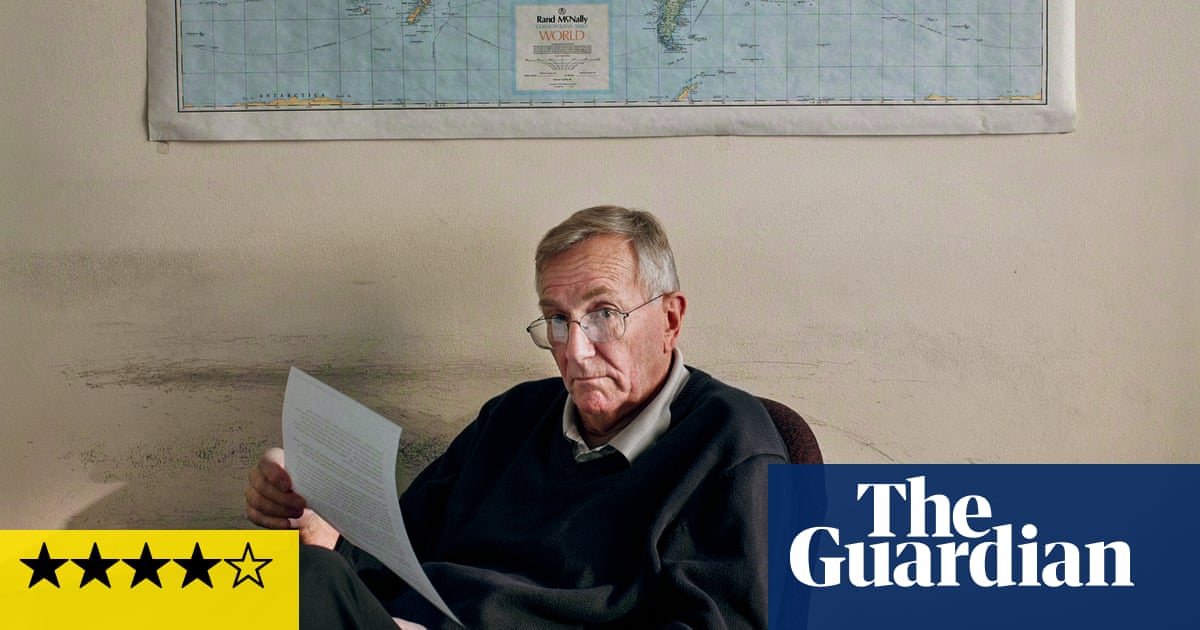

US treasury secretary Scott Bessent has thrown more fuel on the fire overnight, by accusing China of trying to hurt the world’s economy.

Bessent criticised Beijing for imposing new export controls on rare earths last week – a move which riled president Trump – suggesting the move would backfire.

“This is a sign of how weak their economy is, and they want to pull everybody else down with them. Maybe there is some Leninist business model where hurting your customers is a good idea, but they are the largest supplier to the world.

If they want to slow down the global economy, they will be hurt the most.”

Bessent’s comments come as the mood in the markets turns sour again, following a rally on Monday after Trump seemed to calm a situation which he inflamed on Friday by threatening China with 100% tariffs

Stock markets across the Asia-Pacific region are mainly in the red today, with China’s CSI 300 index down 0.6%, Hong Kong’s Hang Seng losing 1.2% and Japan’s Nikkei dropping by 2.1%.

Cryptocurrencies are also weakening, with Bitcoin dropping by 2.7% and ether shedding 5%.

The row threatens to overshadow the annual meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF) which are taking place in Washington DC this week.

The agenda

-

7am BST: ONS labour market

-

8am BST: UK grocery inflation data

-

9am BST: IEA’s monthly oil market report

-

2pm BST: IMF World Economic Outlook press briefing

-

3.15pm BST: IMF’s Global Financial Stability Report

Key events Show key events only Please turn on JavaScript to use this feature

The US also began imposing tariffs on imported lumber, kitchen cabinets and some furniture today.

The new levies, announced by Donald Trump last month, will introduce a 10% tariff on imports of softwood lumber, while duties on certain upholstered furniture and kitchen cabinets start at 25%.

The White House claimed the duties will boost US industries and protect national security. But, as they’re paid by the importer, they risk pushing up the cost of building and fitting out a home.

Trump and Xi still on track for meeting, Bessennt says

Scott Bessent has also revealed that US president Donald Trump remains on track to meet Chinese leader Xi Jinping in South Korea in late October

Spealing to Fox Business, Bessent said:

“The 100% tariff does not have to happen. The relationship, despite this announcement last week, is good. Lines of communication have reopened, so we’ll see where it goes.”

“President Trump said that the tariffs would not go into effect until November 1. He will be meeting with Party Chair Xi in Korea. I believe that meeting will still be on.”

Bessent also claimed that “We have substantially de-escalated,” – shortly before appearing to re-escalate by accusing China of trying to damage the the global economy.

US and China to roll out tit-for-tat port fees today

A new front has opened up in the bubbling US-China trade tensions today too – at the two country’s ports.

From today, the US and China will begin charging additional port fees on ocean shipping firms.

China said today it had started to collect the special charges on U.S.-owned, operated, built, or flagged vessels. Chinese-built ships would be exempted from the levies, though.

The US is also scheduled to start collecting similar fees today on ships linked to China. This is an attempt to shake China’s grip on the global maritime industry and bolster U.S. shipbuilding.

Athens-based Xclusiv Shipbrokers Inc said in a research note:

“This tit-for-tat symmetry locks both economies into a spiral of maritime taxation that risks distorting global freight flows.”

Introduction: Scott Bessent accuses China of trying to damage global economy

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Tensions between the US and China continue to swirl, even though fears of a renewed trade war cooled on Monday.

US treasury secretary Scott Bessent has thrown more fuel on the fire overnight, by accusing China of trying to hurt the world’s economy.

Bessent criticised Beijing for imposing new export controls on rare earths last week – a move which riled president Trump – suggesting the move would backfire.

“This is a sign of how weak their economy is, and they want to pull everybody else down with them. Maybe there is some Leninist business model where hurting your customers is a good idea, but they are the largest supplier to the world.

If they want to slow down the global economy, they will be hurt the most.”

Bessent’s comments come as the mood in the markets turns sour again, following a rally on Monday after Trump seemed to calm a situation which he inflamed on Friday by threatening China with 100% tariffs

Stock markets across the Asia-Pacific region are mainly in the red today, with China’s CSI 300 index down 0.6%, Hong Kong’s Hang Seng losing 1.2% and Japan’s Nikkei dropping by 2.1%.

Cryptocurrencies are also weakening, with Bitcoin dropping by 2.7% and ether shedding 5%.

The row threatens to overshadow the annual meetings of the World Bank Group (WBG) and the International Monetary Fund (IMF) which are taking place in Washington DC this week.

The agenda

-

7am BST: ONS labour market

-

8am BST: UK grocery inflation data

-

9am BST: IEA’s monthly oil market report

-

2pm BST: IMF World Economic Outlook press briefing

-

3.15pm BST: IMF’s Global Financial Stability Report

.png) 1 month ago

47

1 month ago

47