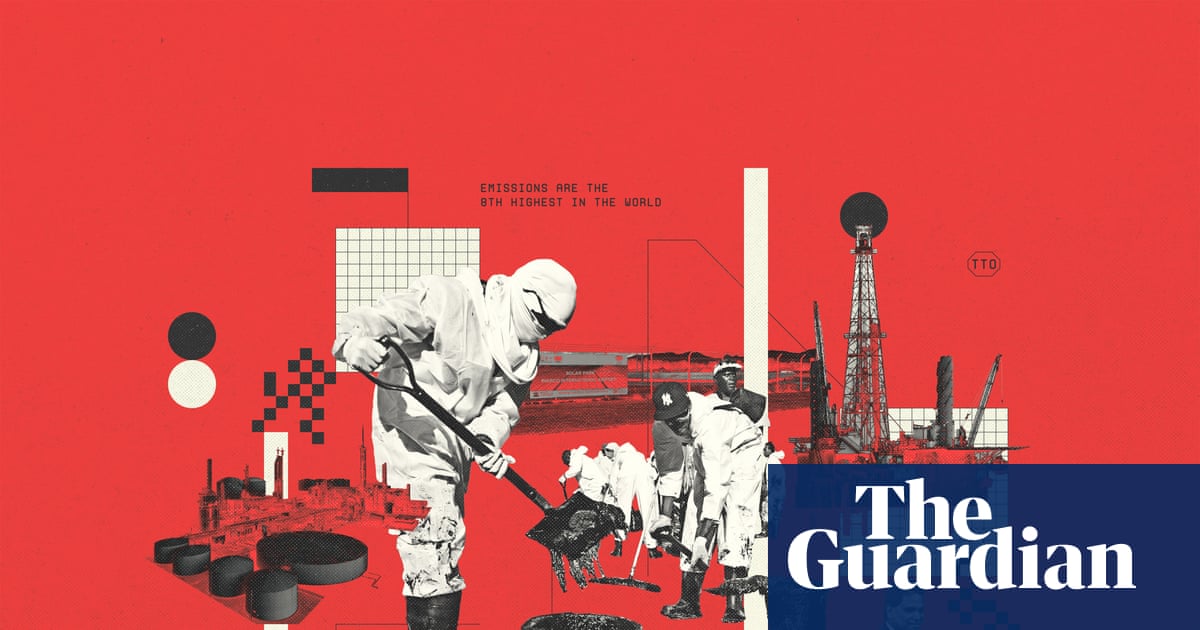

Britain’s biggest energy supplier has told MPs that bills are on track to climb by a fifth in the next four years, even if wholesale markets plummet, because of the rising cost of government policies.

An executive at Octopus Energy said household energy bills were likely to rise by 20% unless the government took radical action to address the burden of increasing “non-commodity costs”, even in a scenario where wholesale electricity prices fell by half.

Rachel Fletcher, its director for regulation and economics, made the stark warning before MPs at a select committee hearing on Wednesday.

Fletcher, who has held senior positions at Britain’s energy and water industry regulators, said “serious and urgent consideration” was needed to address the rise in non-commodity costs, which include levies paid through bills to support upgrades to gas and electricity networks, running the energy system and subsidising low-carbon power projects. This could include delaying investments that were not needed by the UK energy system in the short term, she added.

Fletcher appeared before the committee alongside senior executives from Britain’s biggest energy suppliers. Chris Norbury, the chief executive of E.On UK, said the supplier’s own modelling had suggested that even if the wholesale price was zero bills would still be where they were today because of the increase in non-commodity costs.

Ed Miliband, the energy secretary, has repeatedly blamed the global gas market for rising energy bills, and has said breaking the country’s reliance on gas-fired power plants would help to reduce bills by up to £300 a year by 2030.

The typical household energy bill under the government’s price cap has climbed to £1,755 a year for the average dual-fuel customer this winter, despite market prices falling in recent months.

The cap is now just over £500 a year higher than in the winter before Russia’s invasion of Ukraine accelerated already increasing gas market prices. However, only about £200 of this higher cap can be directly attributed to the wholesale cost of energy.

Other costs that have risen over recent years include the price of upgrading Britain’s energy networks, which has increased by more than £140 annually in the last four years to £396 a year under the cap. Policy costs, which include supporting low-carbon electricity projects, have climbed by £86 a year to £215 under the current price cap.

“It’s time we got this burden under control,” Fletcher said. “There’s no budgetary control of this and yet it all ends up on household bills or contributing to making our electricity some of the most expensive in the industrialised world.

“We need to get the growth of this burden under control with some proper budgetary control like we have over other taxes.”

after newsletter promotion

Fletcher and Norbury told MPs that removing gas plants from the UK market would not be a magic bullet for the country’s energy cost crisis unless the fundamental drivers behind energy bills were addressed.

“We need a government that is looking at a range of radical options alongside the regulator and other parts of the energy system to much more quickly address the path that we’re on before it’s too late,” Fletcher said.

The government has been approached for comment.

.png) 1 month ago

50

1 month ago

50