Rachel Reeves has said higher taxes on the UK’s wealthy will form part of next month’s budget, as she shrugged off the “scaremongering” and “bleating” of her critics, and stressed her determination to repair the public finances.

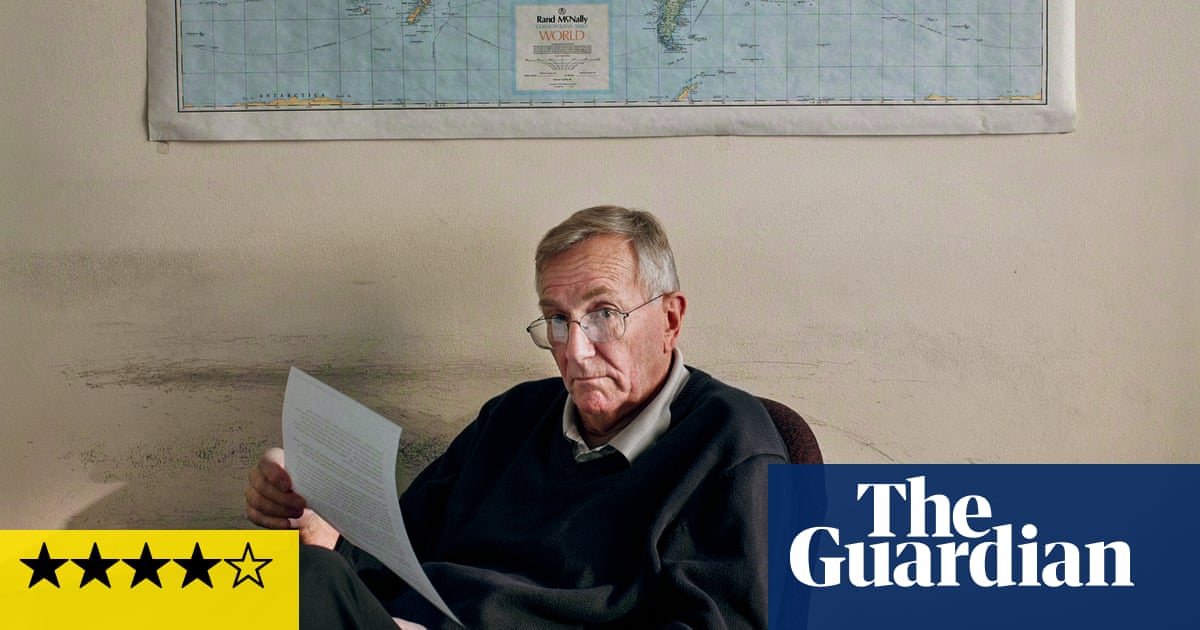

Speaking in Washington, where she is attending the annual meetings of the International Monetary Fund (IMF), the chancellor told the Guardian there “won’t be a return to austerity” and hinted at tax increases for the most well-off.

Reeves is expected to announce a package of tax rises on 26 November, in response to a downgrade in future growth forecasts from independent forecaster the Office for Budget Responsibility (OBR).

Asked whether higher taxes on the wealthy would feature, the chancellor said “that will be part of the story”.

She added: “Last year, when we announced things like the non-doms, like the [tax increase for] private equity, like the VAT on private school fees, there was so much bleating that it wasn’t going to raise the money – that people would leave.

“The OBR will publish updated numbers on all of those things. And that scaremongering didn’t pay off, because this is a brilliant country and people want to live here. And I think, when people scaremonger again this year, we should take some of that with a pinch of salt.”

Reeves has previously ruled out imposing a new “wealth tax” but campaigners for changes to the system have highlighted other options, including: raising the rate of capital gains tax; levying national insurance on rental income and on partners in law firms and consultancies; and creating higher council tax bands.

There is also speculation she will revive plans to overhaul tax-free Isas to divert cash towards the UK stock market.

Reeves declined to comment on specific measures, though she stressed the package would be aimed at boosting economic growth, as well as raising revenue.

Last year’s budget included an historic £40bn of tax increases and fuelled a furious backlash from business, which bore the brunt of the rise in national insurance contributions.

Asked whether spending cuts would form part of the budget package, Reeves pointed to potential cost-savings from the use of new technologies; but stressed that departmental budgets had been set in this year’s spending review.

She hopes to deliver a decisive budget which will persuade bond markets to lower the UK’s borrowing costs and she repeatedly contrasted her approach of sticking to Labour’s investment plans in the face of the deteriorating outlook, with the approach of the Conservatives and Reform.

“In the budget next month, there won’t be a return to austerity. We know that we face a changing global environment in terms of the economy at the moment. But last year, I put investment in, to reduce waiting lists, to build housing, to build the energy infrastructure to get people’s bills down sustainably, not through quick fixes, and we’ll stick to that course.”

Asked how she would explain the need for further tax rises, Reeves said she hoped the public would recognise the global economic outlook had darkened.

“I think people can see that this year, in 2025, the world’s been a very, very volatile place,” she said. “You turn on your TV every night, it might not always be about the economy, but every night, one of the top two or three stories on the news is going to be around some sort of global tensions that is having repercussions at home. So I think that the British people recognise all of that.”

She added: “I’m being honest and I think the British people respect that and it means I’m not always able to offer the easy answers and the platitudes and the false promises.”

However, she criticised the OBR for the politically awkward timing of its productivity review, coming after Reeves carried out a spending review in June. “I think that it would have been a lot better if they had adjusted their forecasts the year before the election, or even last summer, to enable the new government to really understand the economic position.”

The OBR reviewed its forecasting model over the summer, focusing on the outlook for productivity, which has been undershooting OBR projections for several years.

after newsletter promotion

Reeves said: “Those forecasts are going to change this year, but it does reinforce what I said all the way through the election campaign, that the number one priority of this government is to grow the economy.”

She pointed to the Tories’ policy of austerity and the impact of Brexit as the key factors behind the UK’s weak productivity record, which stretches back to the global financial crisis of 2008.

Experts expect the independent forecaster to say the public finances look £10bn-£20bn weaker in five years’ time, than it believed at the spring statement in March. That downgrade comes in addition to the £10bn cost of Labour’s U-turns on the winter fuel allowance, and botched reforms to disability benefits.

As well as closing that gap, Reeves is expected to use the budget to build up greater headroom against her fiscal rules, to cushion the UK against volatility in government bond markets, which has a knock on effect on the Treasury’s borrowing costs.

When the £10bn margin for error she allowed herself in last year’s budget looked set to be wiped out at the time of the spring statement, she chose to respond with welfare cuts – which were subsequently rejected by Labour MPs. She believes a larger buffer will contain the impact of market jitters on policymaking.

Reeves said by getting a grip on the finances, she hopes to convince investors to close the gap that emerged between the UK’s borrowing costs and those of other large economies at the time of Liz Truss’s disastrous mini-budget in 2022.

“When Liz Truss and Kwazi Kwarteng did their mini-budget three years ago, our bond yields decoupled from other G7 economies and they are still at an elevated level compared to other countries. I want to bring us back in line.”

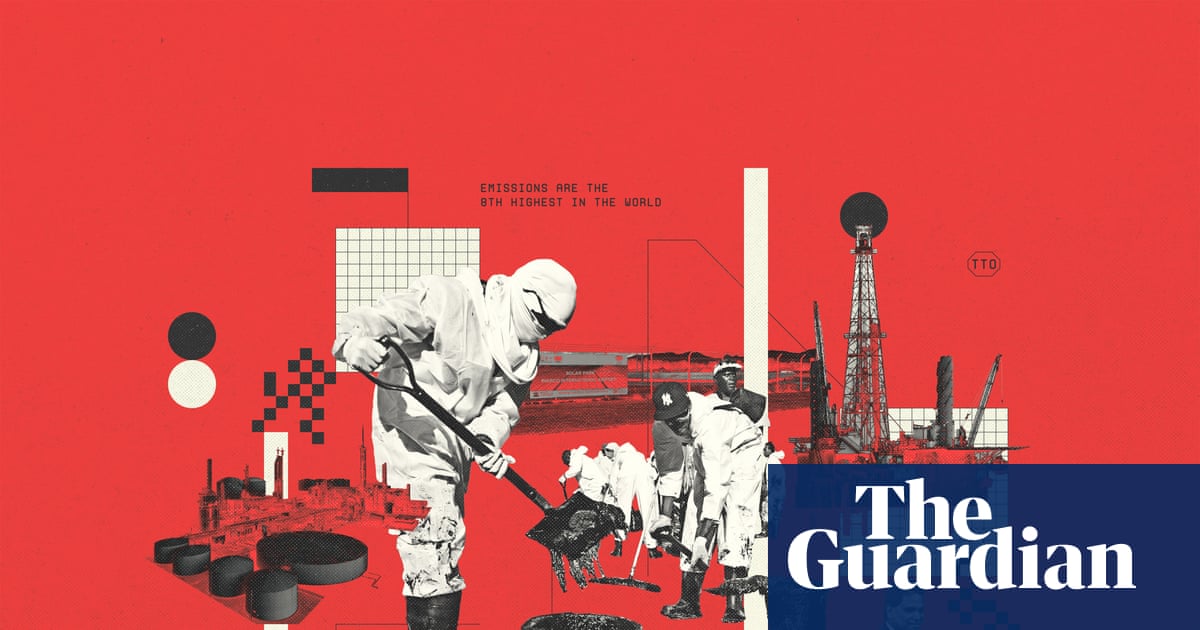

She said that the UK now spends more than £100bn a year on interest alone – with much of it going to overseas investors.

“If you say to people, ‘What would you like to spend more on?’ They’re going to say, schools, hospitals, police on our streets, parks, and local facilities. No one’s going to say, ‘We’re keen that we spend more on servicing our debt to US hedge funds. And yet that is the item of spending that went up the most under the previous government, and there is absolutely nothing progressive about it,” she said.

“I’m providing that confidence to people who buy government bonds that I’ve got a grip on the public finances. And if we can continue to do that, I am convinced we can bring down those borrowing costs.”

Reeves flew into Washington presenting the UK as a “beacon of stability”. But the IMF’s latest forecasts, published as the annual meetings kicked off, showed UK consumers suffering the highest inflation rate in the G7 this year and next.

.png) 1 month ago

57

1 month ago

57